Bitcoin and Ethereum ETFs Experience Massive Outflows Amid Market Volatility

By: Isha Das

In recent developments, U.S.-listed spot Bitcoin and Ethereum ETFs have experienced significant outflows, shedding over $1 billion in just three days. This marked retreat follows a short-lived rally at the beginning of 2026 when inflows saw approximately $1.2 billion funneled into these funds. The rapid reversal has left the month’s net flows at a mere positive balance of around $40 million.

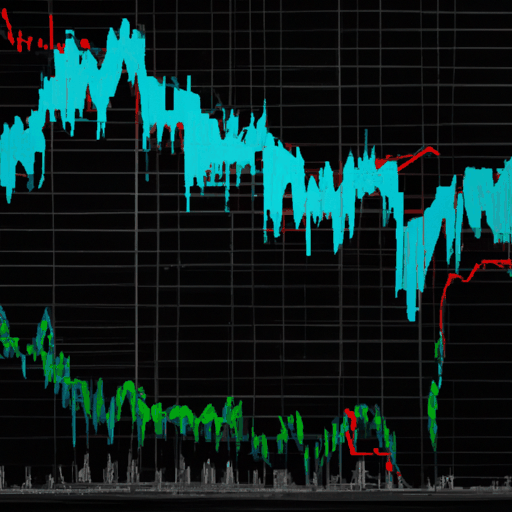

Starting from January 6th, funds have shifted gear dramatically, with outflows amounting to $243.2 million, $486.1 million, and $398.8 million over January 6th through January 8th, respectively. This exodus raises concerns about the sustainability of the previously strong demand for Bitcoin and Ethereum ETFs. The selling pressure was largely driven by institutional investors, with key funds from investment giants like BlackRock and Fidelity leading the retreat. The de-risking seems to be a structural move rather than a retail panic, highlighting the cautious stance of larger market players.

Bitcoin’s market movements echoed this volatility. After hitting highs above $94,000, the cryptocurrency witnessed a dip, challenging support levels below $90,000. Analysis revealed that on-chain dynamics have shifted, with Bitcoin's apparent demand slipping into negative territory. This suggests that while the market's base case predicts a stable floor provided by large-scale holders, the absence of robust fresh demand might stifle upside movements. Insights from CryptoQuant suggest that new capital absorption is not keeping up with available supply, potentially prolonging the period of price stagnation.

Macro indicators also paint a complex picture as gold continues to shine, capturing a larger share of global reserves, while the US dollar grapples with waning dominance. This backdrop of monetary shifts and cautious financial markets suggests that cryptocurrencies like Bitcoin and Ethereum might face further stagnation, caught between a high institutional floor and macroeconomic headwinds. Investors are advised to remain vigilant as unexpected catalysts could sway these assets off their current trajectory.