Bitcoin ETF Markets Witness Record Outflows Amid Price Drops

By: Eliza Bennet

Overview

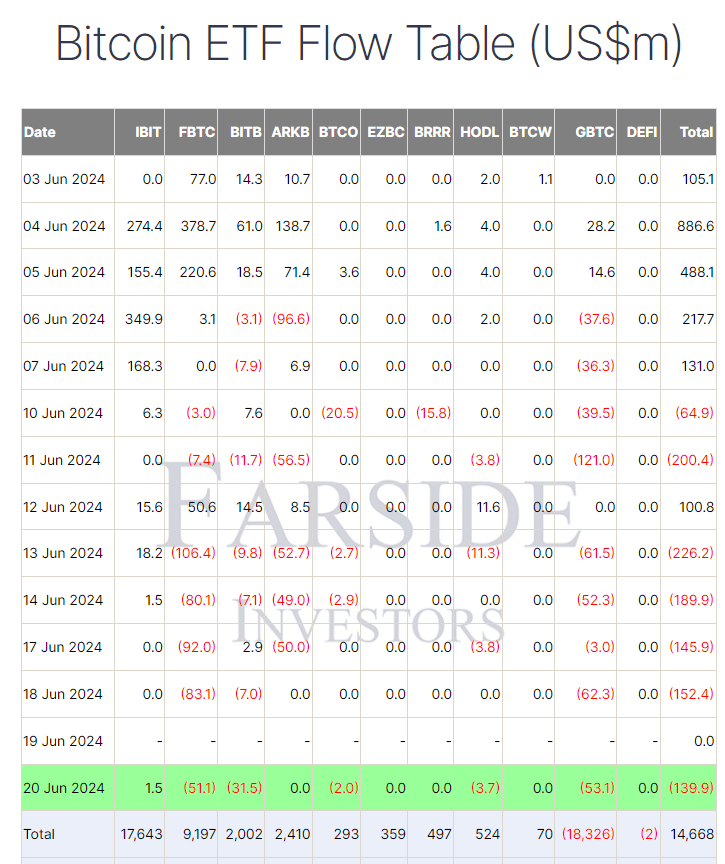

In recent developments, Bitcoin (BTC) exchange-traded funds (ETFs) have experienced significant outflows, culminating in a cumulative pullout of $900 million over the past week. According to data from Bloomberg, June 20 alone saw a massive outflow of $139.9 million. This marks the fifth consecutive trading day of net outflows and the seventh outflow in eight trading days, making it the worst period for U.S.-listed Bitcoin ETFs since mid-April.

Individual Performance

Among the ETF issuers, BlackRock’s IBIT stood out as the only fund to record an inflow, albeit a modest $1.5 million, pushing their total net inflow to $17.6 billion. In stark contrast, Grayscale’s GBTC led the outflow trend with $53.1 million, bringing its total outflow to $18.3 billion. Fidelity’s FBTC followed closely with a $51.1 million outflow, reducing its total net inflow to $9.2 billion. Bitwise’s BITB also saw a notable outflow of $31.5 million, lowering its total inflow to $2.0 billion. Despite these significant outflows, the total net inflows to Bitcoin ETFs remain substantial at $14.7 billion.

Market Reaction

The persistent outflows have critically impacted Bitcoin’s market value. On June 21, Bitcoin's price fell below $64,000, reflecting negative sentiment amid these substantial ETF outflows. This drop comes despite the overall bullish performance year-to-date, leading analysts to speculate on the underlying factors driving this trend. The outflows could be driven by profit-taking activities or a shift in investor sentiment regarding the short-term performance of Bitcoin.

The significant outflows present a mixed signal to the market; while the net inflows remain robust, the recent trend highlights growing investor concerns. Stakeholders and market analysts will be closely watching the ETF markets for any signs of stabilization or continued outflows that might further impact Bitcoin’s market trajectory.

Looking Forward

As the cryptocurrency market navigates these turbulent times, all eyes are on regulatory developments and market fundamentals that could influence future trends. Major industry players continue to adapt, with institutional investments maintaining a significant presence despite recent outflows. The performance of Bitcoin ETFs will likely remain a key indicator of market health, providing valuable insights into investor sentiment and market direction.

For more details on Bitcoin ETFs, you can visit reputed crypto companies websites.