Bitcoin ETF Outflows Hit $211.1 Million In One Day, Total Surpasses $1 Billion

By: Isha Das

Significant Outflows From Bitcoin ETFs

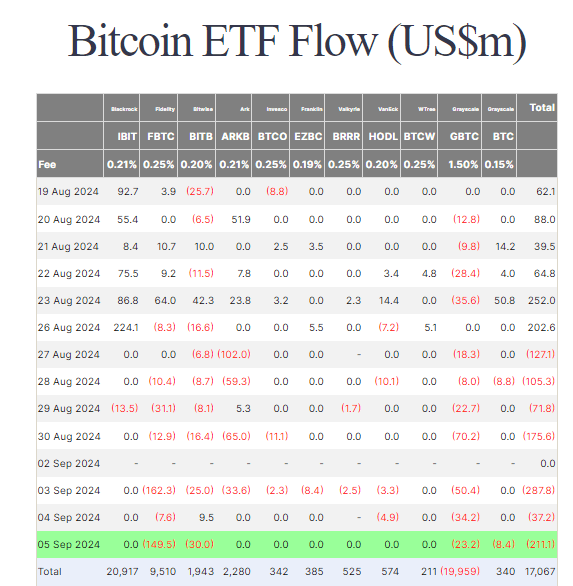

Recent data reveals substantial outflows from Bitcoin ETFs amounting to $211.1 million on September 5th. This marks the seventh consecutive trading day of outflows from Bitcoin ETFs, with no reported inflows on the same day. Four major issuers experienced notable outflows. Fidelity's FBTC experienced the largest drop with an outflow of $149.5 million, followed by Bitwise's BITB at $30.0 million, Grayscale's GBTC at $23.2 million, and other BTC ETFs totaling $8.4 million.

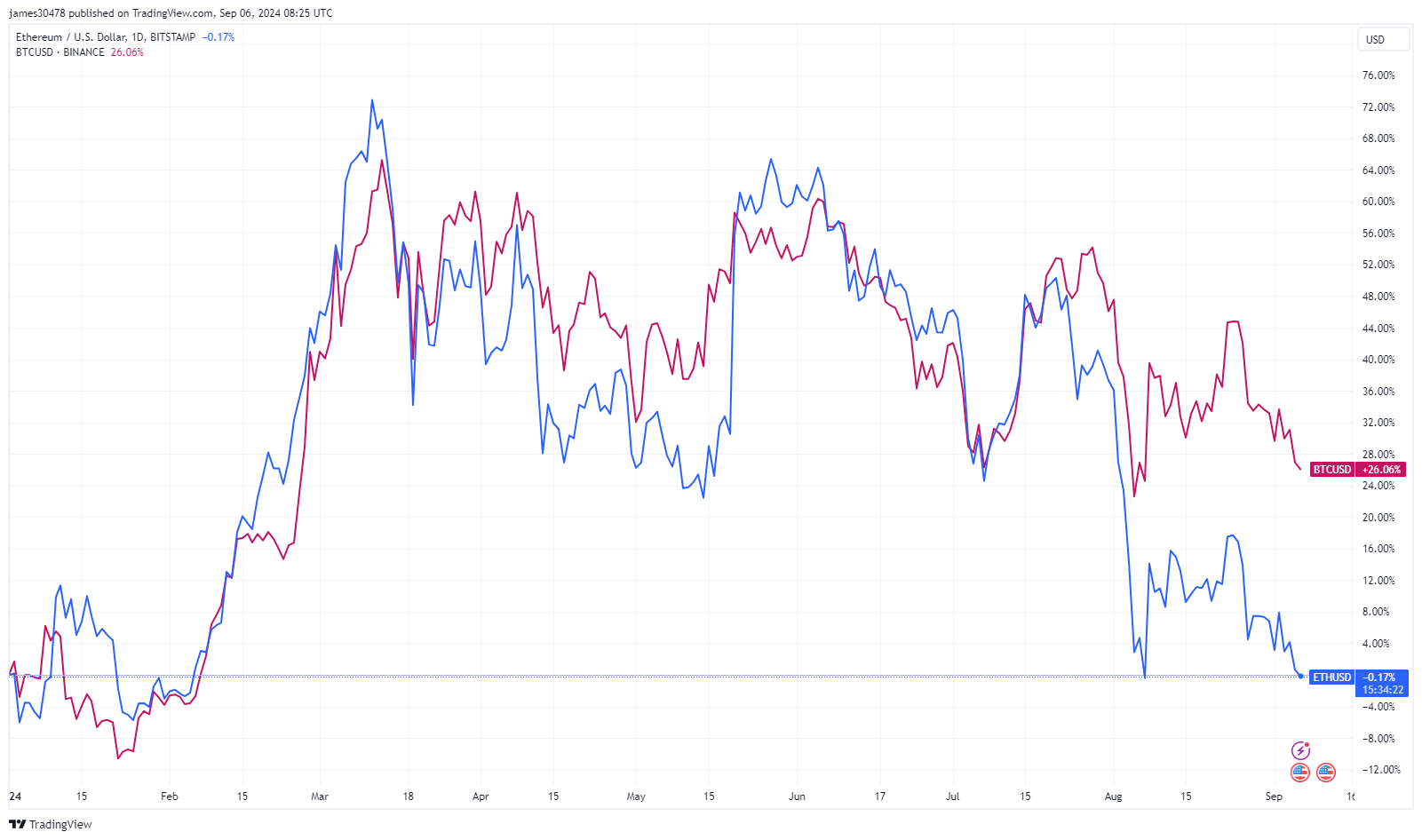

Since August 27th, over $1 billion has exited Bitcoin ETFs, bringing the total net flow to about $17.1 billion. The outflow coincides with a decrease in Bitcoin's price, which has dropped from around $62,000 to approximately $55,500.

Ethereum ETF Dynamics

Ethereum ETFs have seen significantly less activity compared to Bitcoin, with a modest $0.2 million outflow predominantly from Grayscale's products. Specifically, Grayscale's ETHE experienced outflows of $7.4 million, while other ETH ETFs saw an inflow of $7.2 million. Despite these movements, Ethereum ETFs have faced total outflows of $562.5 million, according to the data. As a result, Ethereum's price is now negative for the year.

Despite the ongoing outflows, ETFs remain a popular investment vehicle for institutional and retail investors, providing a regulated and accessible means of gaining exposure to digital assets like Bitcoin and Ethereum.