Bitcoin ETFs Experience Major Influx of $294 Million, Highest Since Early June

By: Eva Baxter

Quick Take

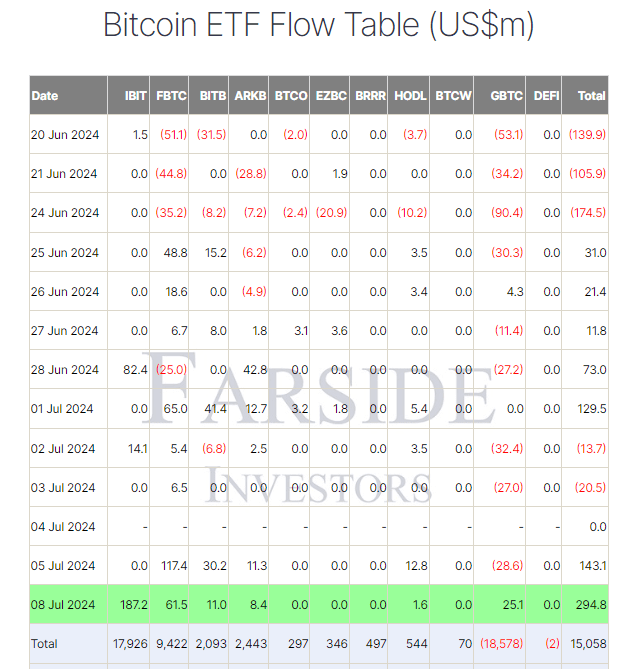

Recent data from Farside highlights a significant surge in Bitcoin ETF inflows, with a massive $294.8 million entering the market on July 8. This marks the most substantial influx since June 5. The standout performer was BlackRock's IBIT, recording an impressive $187.2 million, the highest since June 6. This additional inflow has boosted BlackRock's total net inflow to a remarkable $17.9 billion. Fidelity's FBTC also saw a substantial increase with $61.5 million added, raising its total net inflow to $9.4 billion.

According to Farside, Bitwise's BITB reported an inflow of $11.0 million, bringing its total net inflow to $2.1 billion. Ark's ARKB also saw significant activity with $8.4 million in inflows, totaling $2.4 billion thus far. Grayscale's GBTC, despite its overall outflow of $18.6 billion, reported a $25.1 million inflow. Overall, the total net inflow for all Bitcoin ETFs reached $15.1 billion, demonstrating investor confidence despite the bearish market trends.

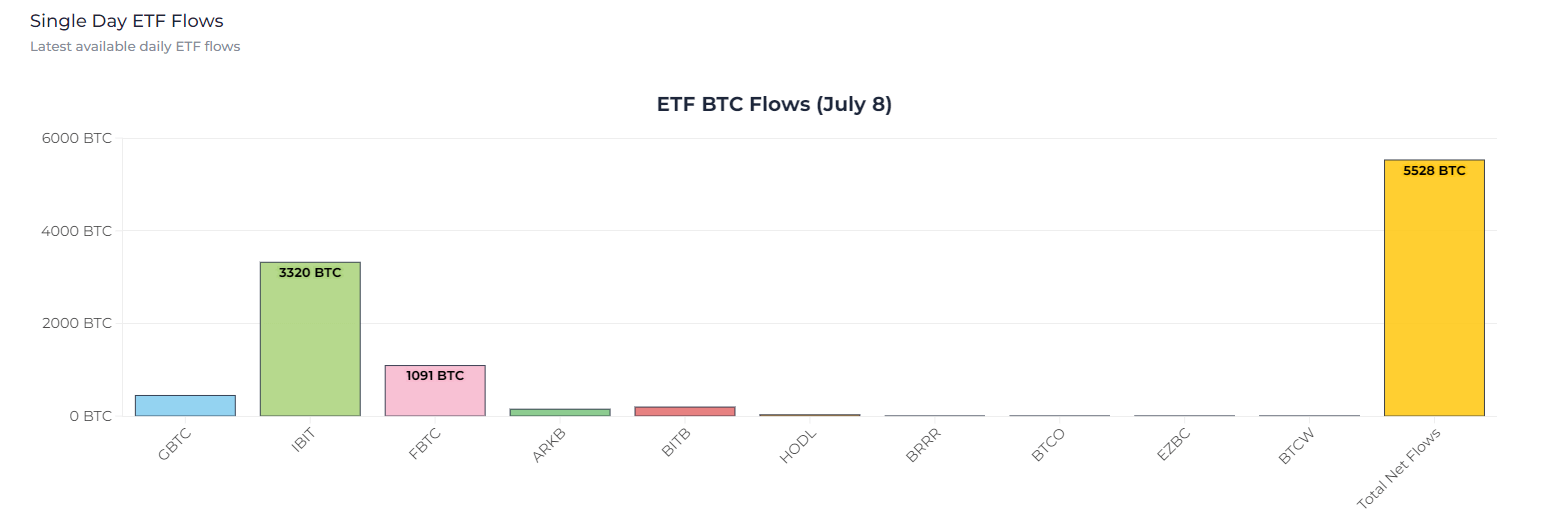

This surge in inflows translates to around 5,528 BTC being injected into the ETFs, according to Heyapollo data. The data underscores a trend where investors are actively buying the dip in Bitcoin prices, which had dropped to below $58,000. The influx of capital into these ETFs reflects a growing confidence among institutional investors in the long-term potential of Bitcoin despite short-term volatilities.

The increased inflows signify strong investor sentiment towards Bitcoin and its ETFs. As noted, sizable movements in ETFs like BlackRock's IBIT and Fidelity's FBTC indicate a robust institutional backing. This trend could potentially set the stage for a more sustained rally, boosting the overall Bitcoin market valuation and inspiring confidence across the crypto market.

The recent influx could also have broader implications for the cryptocurrency market. As institutional investment in Bitcoin ETFs grows, it may trigger further liquidity and stability in Bitcoin trading, making it a more appealing asset class for larger portfolios. The enhanced inflow could indicate a pivotal moment for Bitcoin's adoption in mainstream finance, which remains sensitive to investor confidence and regulatory frameworks.