Bitcoin ETFs Experience Significant $226M Outflow Amid ETH ETF Announcements

By: Eva Baxter

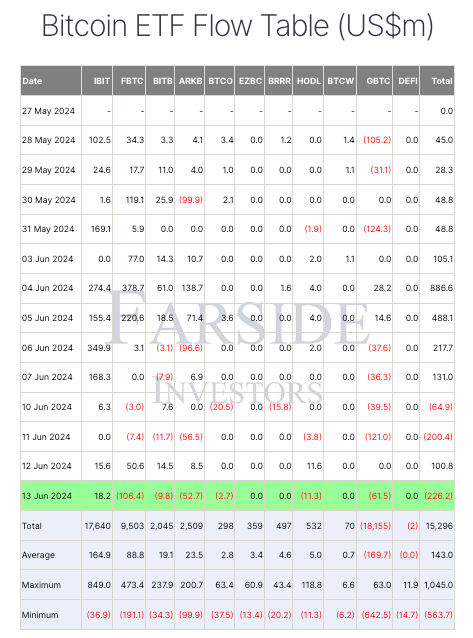

Bitcoin Exchange Traded Funds (ETFs) encountered a substantial outflow totaling $226.2 million on June 13, according to data from Farside. This downturn is sharply contrasted with the $100.8 million inflow recorded just a day earlier, on June 12. The outflows were predominantly led by Fidelity’s FBTC, which saw $106.4 million pulled out, marking its highest outflow in the past month. This comes as a sharp reversal from the $50.6 million inflow it enjoyed just a day before.

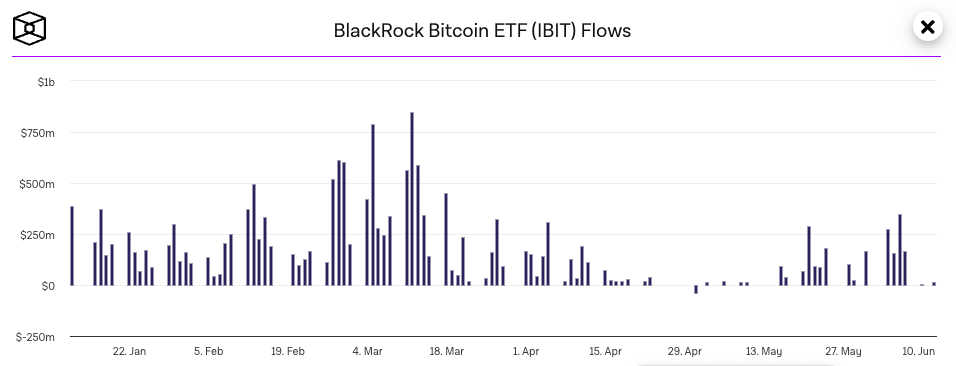

Grayscale’s GBTC followed with an outflow of $61.5 million, and Ark’s ARKB ETF had $52.7 million withdrawn. Interestingly, BlackRock’s IBIT was an anomaly in this trend, recording a positive inflow of $18.2 million. This continuous inflow keeps up with IBIT’s 44-day streak of net inflows, only briefly interrupted since its launch. On May 1, IBIT experienced an outflow of $36.9 million, but the trend has been predominantly positive since then.

The sharp divergence in ETF flows can be attributed to recent market volatility, largely sparked by the U.S. Securities and Exchange Commission’s (SEC) announcement regarding the impending approval of the first spot Ethereum ETFs. According to sources within the SEC, these Ethereum ETFs will receive the green light this summer. Although market analysts hold mixed views on whether ETH ETFs will attract the same level of institutional attention as Bitcoin ETFs, it is clear that the new product will divert some volume from Bitcoin ETFs.

The reaction seen in Bitcoin ETF markets underscores the ongoing volatility and shifting investor sentiment amid regulatory developments. With the news of Ethereum ETFs on the horizon, it’s evident that this new product could siphon some interest from Bitcoin ETFs. However, it remains to be seen whether Ethereum ETFs can sustain the same level of institutional interest over the long term.