Bitcoin ETFs NAV and Market Impact: Analyzing Recent Trends

By: Isha Das

The BlackRock's iShares Bitcoin Trust recorded its first discount to its Net Asset Value (NAV) on January 19, which precipitated a drop to a rate of -0.27%, according to official BlackRock data. Simultaneously, Grayscale's NAV, which saw a significant discount of 48% on December 22, is now registering at a tighter rate of -0.27%. The swift change in Grayscale's NAV was due in large part to the anticipation of its conversion to a Bitcoin ETF and the increased market interest it generated.

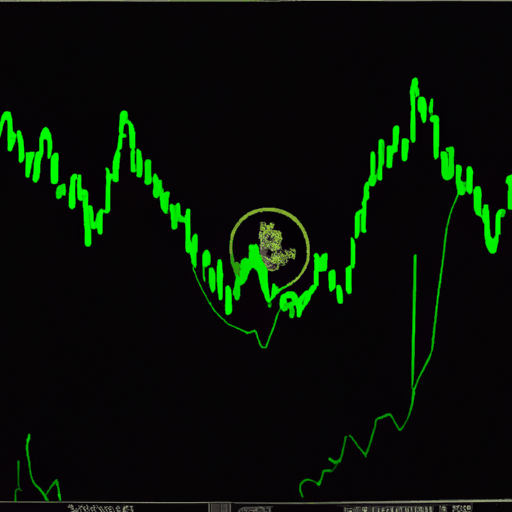

An examination of the iShares Bitcoin Trust's first week reveals a varied NAV per share, starting at $26.59 and decreasing to $23.87 by January 19. The underlying Bitcoin price has recently dropped to around $40,000, which resulted in a 1.72% decrease in IBIT shares. However, if the shares continue to trade in line with Bitcoin, they could potentially reverse to a premium of up to 0.7%.

In contrast, Grayscale has been engaging in marked daily outflows of Bitcoin that coincide with the opening of the U.S. market. This has been perceived as a significant strategic error, with claims that it will continue to depress Bitcoin prices until the full 'liquidation' of the Grayscale Bitcoin Trust (GBTC). Data from Arkham Intelligence suggests that BTC's price will keep decreasing until these large-scale sell-offs are finished.

Crypto analyst Chris J. Terry expects the Bitcoin trend to remain flat or downward until GBTC fully liquidates, anticipating an approximate $25 billion worth of selling activity in the next few weeks. The dynamics of these investment vehicles demonstrate how ETFs influence the overall state of the cryptocurrency market, with the anticipated shift in holdings expected to create potential shifts in Bitcoin prices.