Bitcoin Faces Bearish Threat As Death Cross Emerges

By: Eliza Bennet

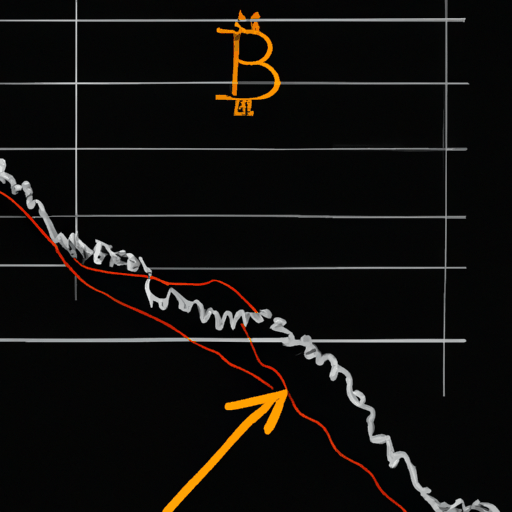

In recent developments within the cryptocurrency market, Bitcoin has experienced a technical crossover ominously dubbed the "death cross." This event, where the 21-day simple moving average (SMA) falls below the 50-day SMA, has historically signaled bearish trends for the cryptocurrency. Noteworthy is the analysis shared by expert Ali Martinez, which highlights past occurrences when such a crossover led to significant price declines, ranging from 54% to as much as 69%. The most severe drop coincided with a 66% decline during the 2022 bear market, raising concerns about the potential for a repeat of such drastic shifts in Bitcoin's value.

Given this situation, Bitcoin's price trajectory in the days ahead remains uncertain. The cryptocurrency's ability to maintain above critical on-chain levels, specifically the Realized Price-to-Liveliness Ratio, could play a pivotal role. This ratio, a blend of the average investor's cost basis on the Bitcoin blockchain and the behavior patterns of long-term holders, is currently situated around $87,500. Bitcoin recently dipped below this level but managed to recover, hovering at approximately $89,500. The potential for a bearish outbreak lingers, with prior instances suggesting that should Bitcoin fall below this ratio, it might aim towards another critical level, the Realized Price, positioned at $56,000.

Chart analysts emphasize the precarious nature of Bitcoin's current setup, urging traders to remain cautious. Several bearish indicators align with the death cross, pointing to further downside potential. While Bitcoin is up 2% in the past week, this minor recovery does little to alleviate concerns over the looming crossover. Investors in Bitcoin must weigh historical data and current technical signals to navigate this possible downturn.