Bitcoin Remains Above $50,000 Amidst New Accumulation Trends

By: Eva Baxter

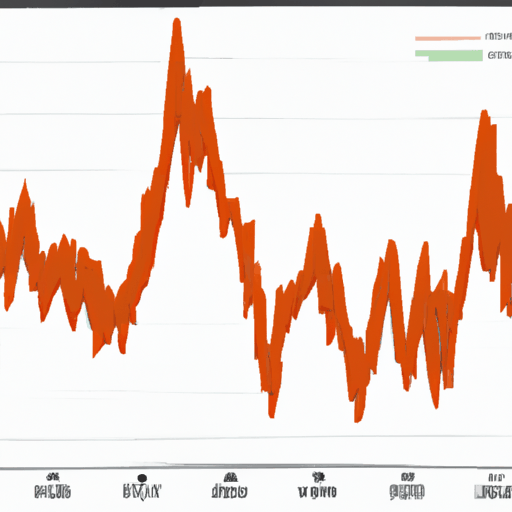

Bitcoin continues to hold its ground, trading above $50,000 for over a week now, hinting at new accumulation patterns across various cohorts. About 111k BTC were held by these groups over the past month, observing a steady shift from heavy distribution to light accumulation, as represented by trends in the Accumulation Trend Score. Taking note, smaller groups possessing fewer Bitcoins could be moving into a period of significant net accumulation.

However, the crypto market remains volatile, as Bitcoin struggled with fluctuations, notably around the $53,000 mark. A crypto analyst remains optimistic, stating Bitcoin's potential to continue its upward trend against the bearish drops, provided the current resistance area is maintained. The same analysts hinted at the prospect of a price surge to new highs, potentially reaching a local top of $54,000 to $58,000, if Bitcoin is able to breach certain levels.

Failing to clear the $53,000 resistance, however, could lead to a downside break, moving Bitcoin below the $50,500 support. Bitcoin's price now remains dependent on clearing this resistance zone, with the next major resistant points being $51,550, $51,800, and $52,500.

Whilst some view this as a sign of incoming bearish momentum, others regard this as a short-lived occurrence, potentially leading to a future surge close to $60,000, presuming the current $50,500 support is held.