Bitcoin Sentiment Surges to Neutral and Greed in Market Rebound

By: Eva Baxter

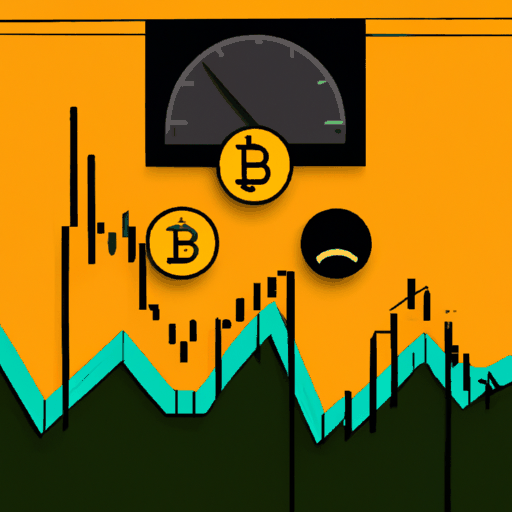

The sentiment in the Bitcoin market has recently seen a significant shift, as indicated by the Fear & Greed Index, an essential tool for assessing investor emotions. This index uses a scale of 0 to 100 to gauge market sentiment, with scores below 47 signifying fear and those above 53 indicating greed. A reading between these values is considered neutral. According to the latest updates, the index has reached a neutral score for the first time since October, reflecting an improved sentiment among traders.

The recent rally in Bitcoin's price, lifting it beyond the $97,000 mark, has played a pivotal role in this sentiment shift. Just a day prior, the index stood at 48, barely in the neutral zone, showing a vast improvement from its previous position at 26, which was well within the fear range. Market analysts attribute this change to bullish momentum that has captivated traders following enhanced market conditions. [Source]

The renewed confidence in the market has subsequently led to a surge in short-liquidations, noted for being one of the largest since October. This is symptomatic of investors adapting to the changing landscape, where the rapid transition from fear to a greed atmosphere enhances trading activities. Data from on-chain analytics firm Glassnode has substantiated this wave of liquidations, illustrating the ripple effects of Bitcoin's upward trajectory on trading behaviors.

Owing to these developments, the Crypto Fear & Greed Index subsequently advanced to a ‘greed’ score of 61, marking its first such occurrence since a substantial $19 billion liquidation event in October. This shift underscores a positive change in overall market sentiment after a prolonged period of fear. The significant change reflects that as Bitcoin continues to climb, traders capitalize on the bullish tendencies, navigating the markets with a renewed bullish outlook.