Bitcoin Spike and Stablecoin Yields Stir Market Dynamics

By: Isha Das

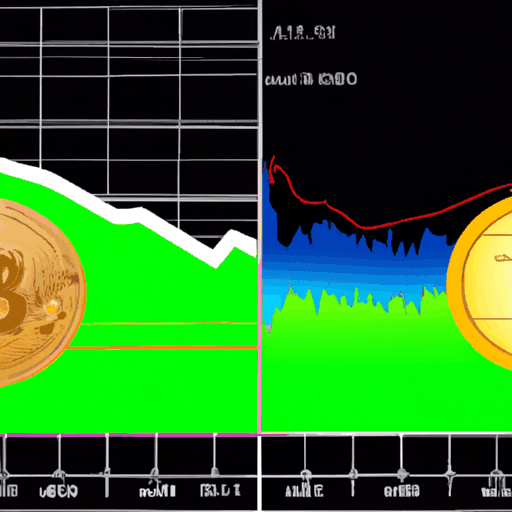

Bitcoin's recent price ascendancy to near $97,000 marks a significant milestone that has not been seen since November, sending ripples across the broader cryptocurrency market. This surge has resulted in a substantial liquidation of nearly $800 million in short positions, reflecting a sweeping impact on bearish traders who were caught off guard by the unexpected price movements. The rally underscores Bitcoin's continued prominence in the digital asset space, and its dominant influence on market trends.

While the spotlight shines on Bitcoin, another contest is unfolding in the realm of stablecoins amid ongoing regulatory developments in the United States. The CLARITY Act is poised to redefine the competitive landscape between traditional banking and decentralized finance (DeFi) platforms. Current legislation aims to delineate the boundaries between 'crypto' and 'securities,' a move seen as essential in fostering stability and trust within the market. However, criticism has surfaced over potential biases in favor of centralized platforms, which some argue could disadvantage DeFi services, undermining their ability to compete equally.

The focus on stablecoins reflects their growing role in financial ecosystems where they serve as alternatives to traditional bank deposits by offering competitive yields. Typical rates from stablecoin platforms often hover around or even exceed those found in traditional banking – a gap exemplified by the FDIC’s reported average rates of 0.39% for savings compared to a 3.89% treasury reference yield. These yields offered by stablecoins like USDC compel consumers to question the lower returns provided by banks, putting pressure on conventional financial institutions to either increase their deposit rates or seek alternative funding models.

Financial institutions express concern over the regulatory framework that could allow stablecoins to operate similarly to cash and provide yields akin to those from government securities. The potential reevaluation of how rewards are categorized and taxed could significantly impact the sector, shaping both consumer behaviors and institutional strategies. As congress deliberates, the banking sector watches closely, wary of stablecoins disrupting traditional banking relationships and offering competitive alternatives for managing liquid assets.