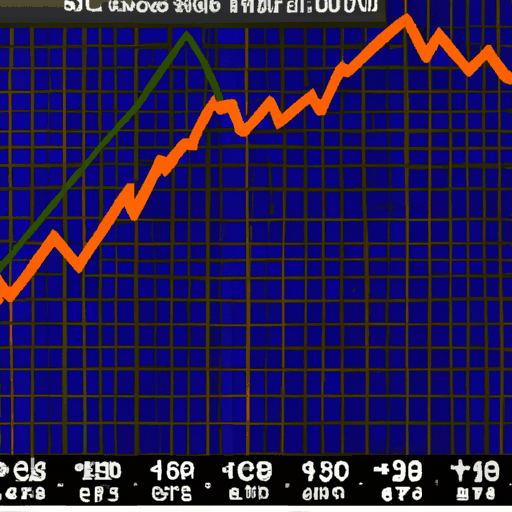

Bitcoin Value Increases Ahead of Upcoming Halving Event

By: Isha Das

Bitcoin's value has surged to $65,000 ahead of its highly anticipated Halving event, scheduled to occur late tonight. This potential volatility follows a steady trend of withdrawal streaks from Bitcoin Spot ETFs, having the most significant reduction from GBTC. Meanwhile, BlackRock's IBIT has experienced a slow rate of inflows, according to the latest provision data.

Both market behavior and on-chain data reveal how Bitcoin miners have historically reacted during these periods. This Halving, a periodic event that takes place approximately every four years, involves the permanent halving of Bitcoin's block rewards. These rewards serve as the primary income for miners, compensated for solving blocks on the Bitcoin network. Miners' selling behavior at this time often causes significant selling pressure, observable through metrics such as the Miner to Exchange Flow.

Nevertheless, the nervous jitter in the past six months' Bitcoin rally has led to speculations that any significant impacts of the halving will be cushioned for the miners. CryptoQuant research analysts suggest Bitcoin miners may have completed the latest round of selling in advance. If true, this could benefit the market in the short term even if the Halving results in a reduction of revenues for miners.

While the Bitcoin value continues to hover around $63,500, the anticipation surrounding the upcoming Halving event continues to create ripples in the market.