Bitcoin Volatility Prompts Massive Sell-Off Among Short-Term Holders

By: Isha Das

Market Impact

Bitcoin experienced significant market fluctuations, causing short-term holders to offload their assets at a loss. On May 23, the digital currency's value dipped to around $66,300. This downturn was attributed to the S&P US Composite PMI Flash exceeding expectations, which deferred anticipated rate cuts. For more insights into market reactions, visit the complete analysis.

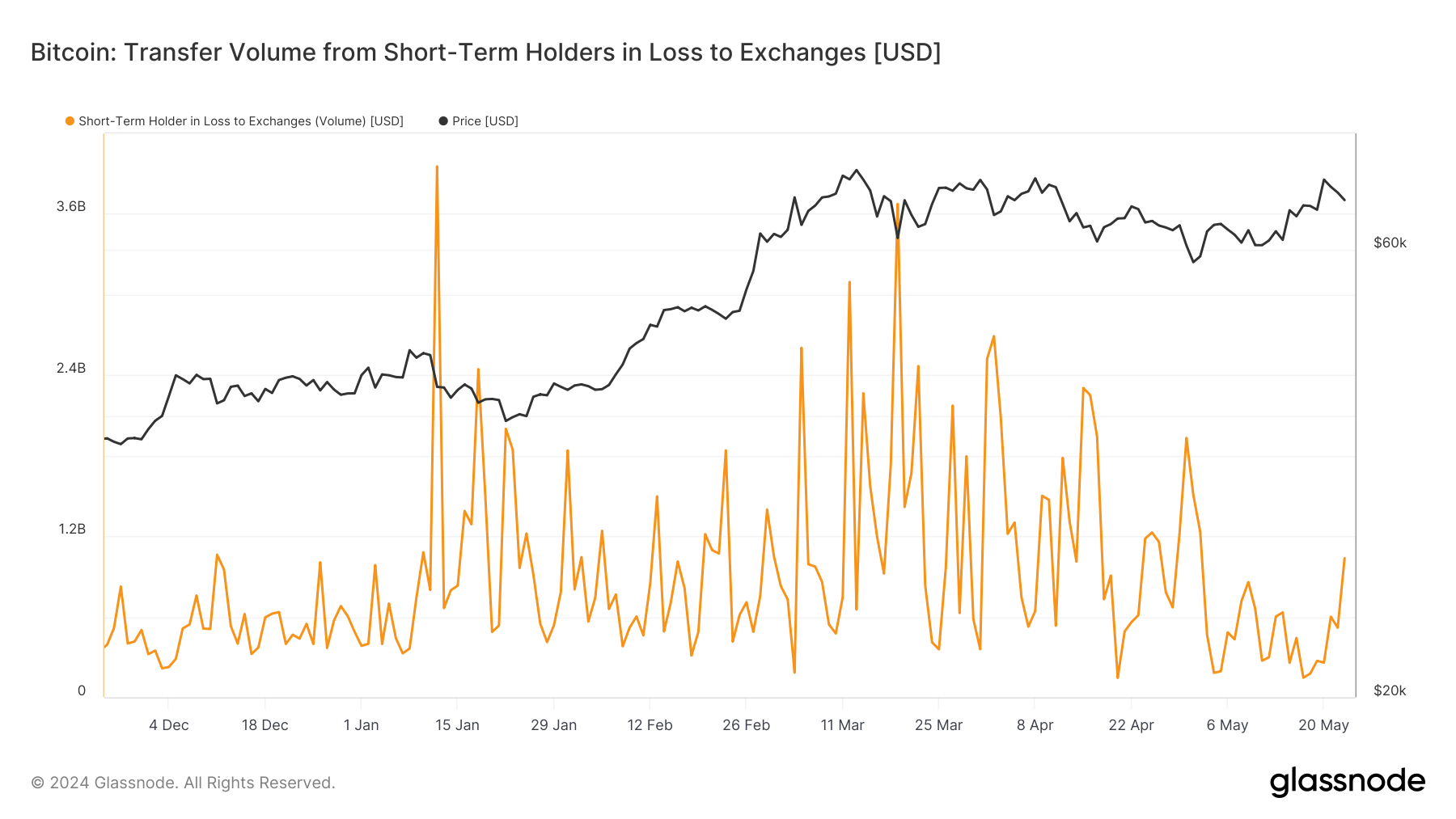

According to Glassnode, short-term holders offloaded over $1 billion worth of Bitcoin, amounting to approximately 15,000 BTC, marking the highest sell-off since May 2. Encouragingly, each sell-off indicates decreasing pressure, suggesting growing resilience among investors.

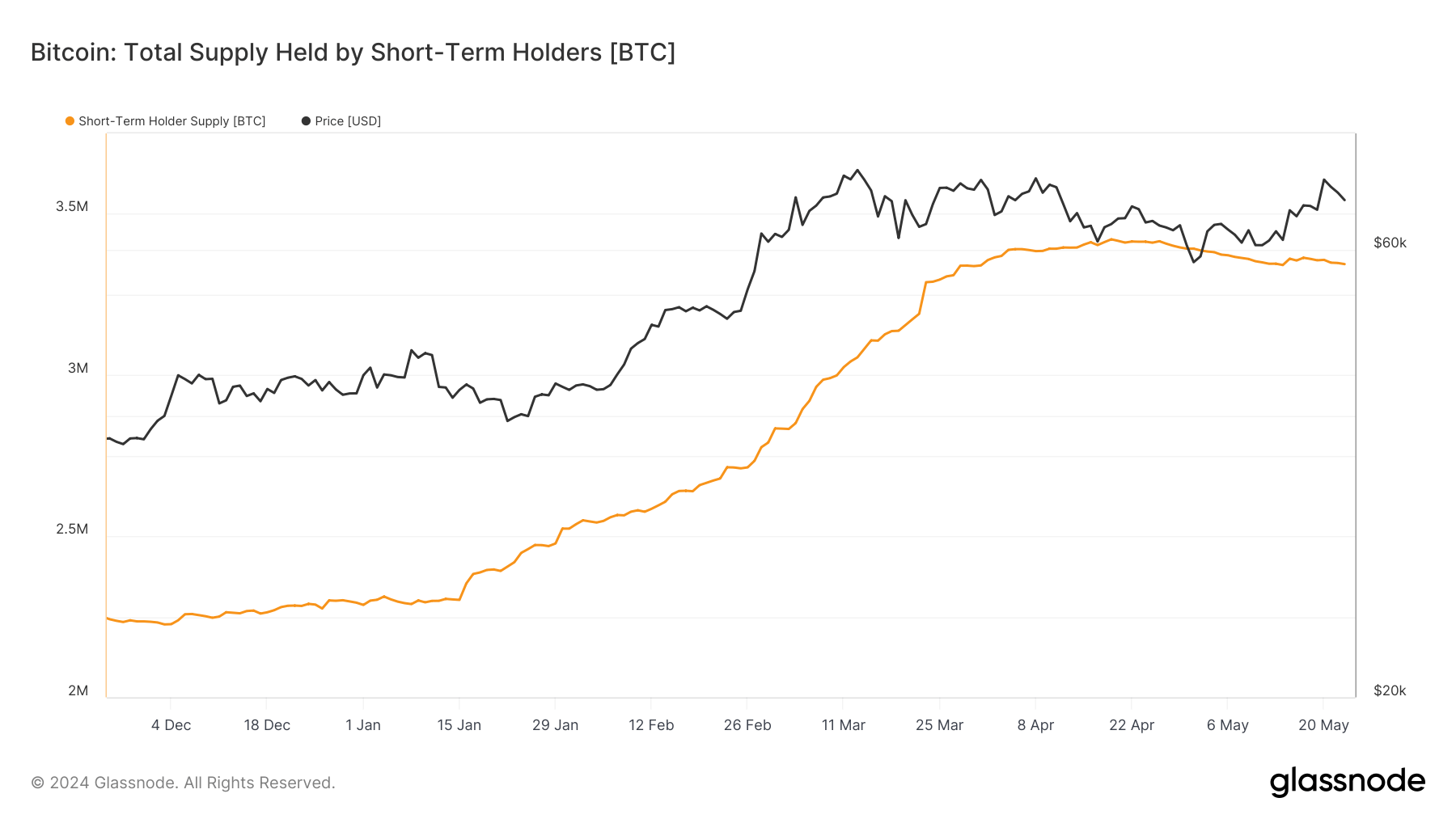

Further data from Glassnode reveals a decline in Bitcoin supply held by short-term investors, dropping from 3.4 million BTC in April to 3.3 million BTC, showcasing a behavioral shift during a market correction exceeding 20%. Explore more about this investor sentiment change here.

Ethereum's Market Reaction

Meanwhile, Ethereum experienced similar volatility. Following the approval of the U.S. Ether ETF listing, Ether's price responded with a sell-off, embodying a typical speculator's "buy the rumors, sell the facts" reaction. For more on how Ethereum’s market reacted, stay updated with the latest news.