Bitcoin's Risk-adjusted Returns Surge Amid Global Stresses

By: Eliza Bennet

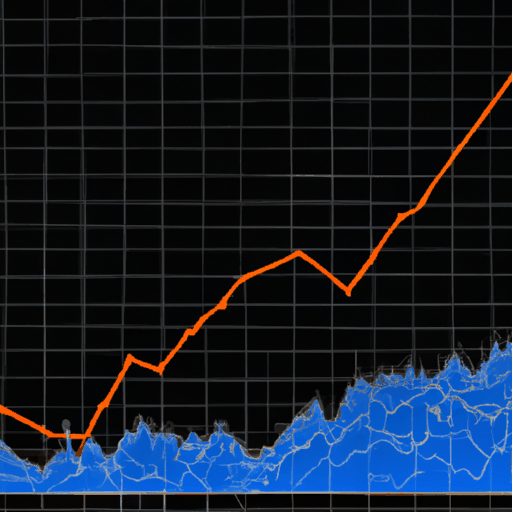

As global stressors continue to exert pressure on financial markets, Bitcoin is gaining from the disorder, showcasing its potential as a worthwhile addition to an investor’s portfolio. Among the key indicators pointing to this trend is Bitcoin’s Sharpe signal, a proprietary index from Glassnode which recently hit its lowest level since March 2020. The Sharpe Signal, which assesses Bitcoin’s risk-adjusted return potential for investors, dipped to 0.2531 before climbing to 0.7371 from Feb. 11 as Bitcoin’s price crossed the $48,000 mark.

The Sharpe Ratio, a standardized measure of expected returns per unit of risk for an investment was created by Nobel Laureate William F. Sharpe. The higher the ratio, the more favorable the risk-adjusted return, making the Sharpe Signal's recent surge a positive signal for Bitcoin investors. Additionally, a decline in the Sharpe Signal suggests increased downside risk or diminishing returns relative to risk, advising investors to proceed with caution.

The surge in Bitcoin’s Sharpe Signal suggests a robust turnaround in market sentiment and outlook on risk-adjusted returns. This indicates a period of significantly improved risk-adjusted returns which could appeal to Bitcoin traders guided by these metrics for strategic investments. With the continuous evolution of on-chain activity and market trends, this tool provides investors with critical insights on the risk-reward balance for Bitcoin investments.

In the face of global market upheavals, Bitcoin has held steady, further cementing its place in any well-diversified investment portfolio. As the cryptocurrency continues to navigate the economic landscape, the rise in the Sharpe Signal demonstrates the profitable potential and low risk associated with investing in Bitcoin.