Bitcoin's Rollercoaster Week: Market Shows Mixed Signals

By: Eliza Bennet

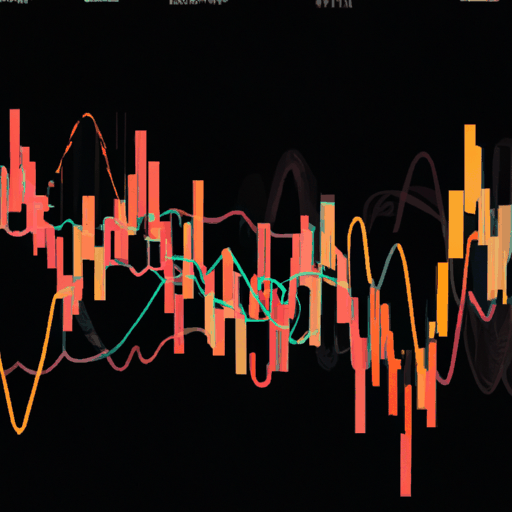

The Bitcoin market has experienced a tumultuous week, with significant events shaping its current landscape. After a drastic dip to $112,000 at the beginning of the week, the cryptocurrency witnessed a liquidation event that cleared over $1.7 billion in leveraged long positions. This major market move, marked by widespread liquidation activity, sent rippling effects across futures and options markets, influencing trader sentiment and positioning.

According to industry data, Bitcoin's recent price drop triggered a massive clearance in long positions, significantly altering the futures landscape. This reaction stemmed partly from the Federal Reserve's latest rate cut, which added a layer of volatility to an already oscillating market. Derivatives analytics indicated that short-term downside protection became a dominant strategy, as evidenced by a higher demand for puts over calls. Such positioning typically signals trader anticipation of further downside movement or volatility spikes.

The market's gaze now turns toward pivotal resistance and support levels, with analysts predicting possible short-term price paths that could lead Bitcoin toward the $124,000 zone or dip further to the $108,000 level. These projections are influenced by observable liquidation clusters around key figures and market sentiment trends. In addition, ETF flows and macroeconomic factors, such as U.S. Treasury yields and the Dollar Index, remain crucial indicators of Bitcoin's potential trajectory.

As the dust from the liquidation settles, the focus will be on whether residual leverage has been sufficiently reduced to allow stable trading conditions. Factors such as funding rates, ETF net flows, and derivatives market bias will significantly guide the next course of market action. Observers and traders remain vigilant, analyzing dashboards and market indicators in anticipation of decisive market movements as Q4 approaches.