BitMart's Strategy Shift and Byrrgis's Strategic Expansion

By: Isha Das

BitMart, a prominent cryptocurrency exchange, has decided to withdraw its application for a virtual asset service provider license in Hong Kong. This development comes after significant regulatory scrutiny and follows similar decisions made by other major crypto platforms like Bybit, OKX, and Gate. The decision was reportedly taken on Thursday, as per the records of the Hong Kong Securities and Futures Commission (SFC), which maintains a list of virtual asset trading platforms.

These withdrawals highlight an emerging trend where cryptocurrency exchanges are reassessing their strategies in response to evolving regulatory landscapes in various jurisdictions. Hong Kong's strict regulatory frameworks have been a significant influencing factor. Such regulatory scrutiny can significantly impact the operational capacities and market reach of cryptocurrency exchanges. Therefore, these platforms must navigate the complex regulatory maze to maintain their competitive positions globally.

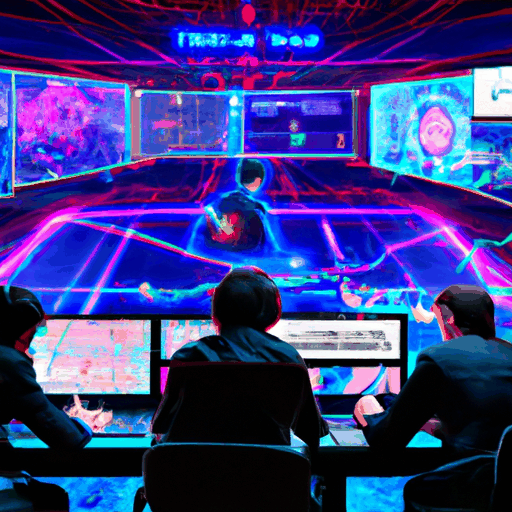

Meanwhile, the latest updates from the Solana-based DeFi intelligence platform, Byrrgis, reveal that its native Wolf Token ($WOLF) has been successfully listed on CoinMarketCap and will commence trading on BitMart. This step is part of a strategic push to bolster Byrrgis's presence in the global DeFi space. By integrating AI-driven and human-led research, Byrrgis aims to offer a 'command center' for professional traders, which aligns with its vision of enhancing trust, transparency, and decision-making capabilities within the DeFi ecosystem.

The listing of $WOLF is pivotal for Byrrgis, as it not only improves token liquidity but also extends its global accessibility. This aligns with Byrrgis's strategic objectives to scale operations and broaden its community of analysts and traders. The initiative underscores the organization's innovative approach to decentralized finance, where enhancing market intelligence and infrastructure is essential for capturing new opportunities in the dynamic DeFi landscape.