BlackRock's Bitcoin ETF Leads Market Inflows Amidst Volatility

By: Isha Das

Overview of Bitcoin ETF Inflows

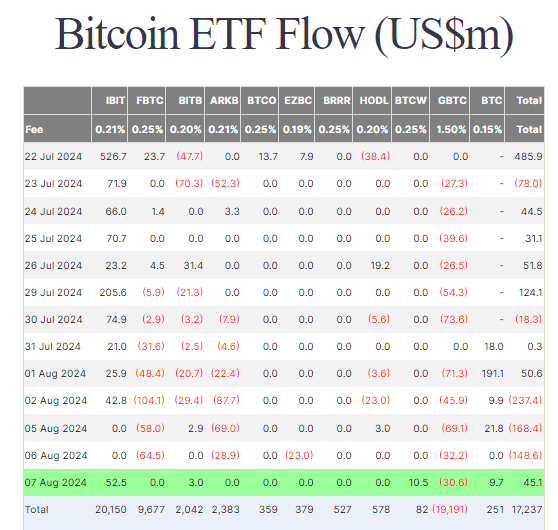

Investors in BlackRock's Bitcoin ETF showcased resilience amidst a week of market volatility, driving inflows of $52.5 million into the ETF. This substantial inflow marked a significant shift in the Bitcoin ETF landscape, underscoring investor confidence in BlackRock's offering. Compounding the inflow, WisdomTree's BTCW posted a $10.5 million increase, while the Grayscale Mini Trust BTC saw a $9.7 million uptick. Despite these gains, the Grayscale GBTC witnessed an outflow of $30.6 million, leading to a cumulative net inflow of $17.2 billion for Bitcoin ETFs. Farside data has been instrumental in tracking these ETF movements.

Ethereum ETF Dynamics

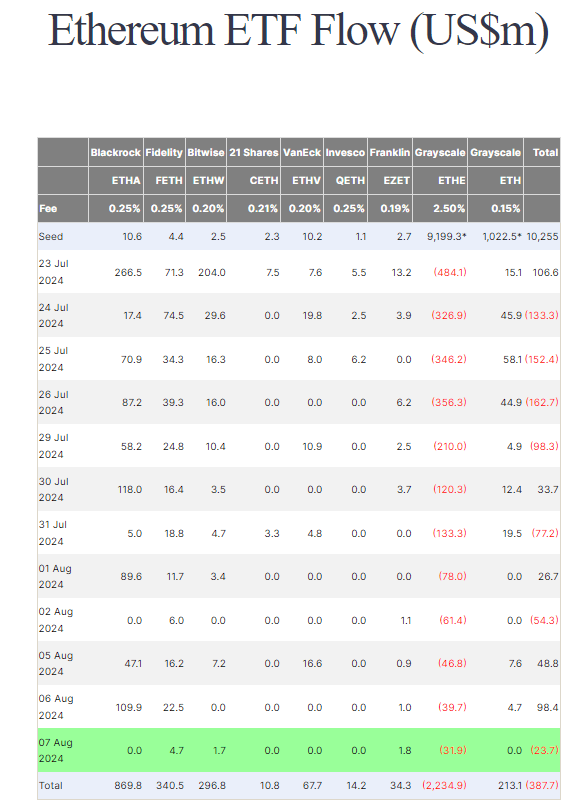

While Bitcoin saw notable ETF inflows, Ethereum ETFs experienced contrasting fortunes. Grayscale's ETHE continued to report outflows amounting to $31.9 million. This trend contributed to a total outflow of $23.7 million for Ethereum ETFs, bringing the cumulative outflows to $387.7 million, highlighting the divergent investor sentiment towards Ethereum compared to Bitcoin.

These market movements come at a time when the overall crypto market is experiencing significant fluctuations. However, the steadfast inflows into BlackRock's Bitcoin ETF suggest continued investor confidence and interest in Bitcoin as a preferred asset.