Compound Finance Proposal Raises Alarm Over 'Governance Attack'

By: Eva Baxter

A recent proposal passed by Compound Finance's decentralized autonomous organization (DAO) has sparked significant controversy among community members and experts. The proposal, which according to Compound's DAO rules is legal, was met with criticism following its passage on Sunday. This move has raised concerns about the potential for what is being termed as a 'governance attack' within the platform.

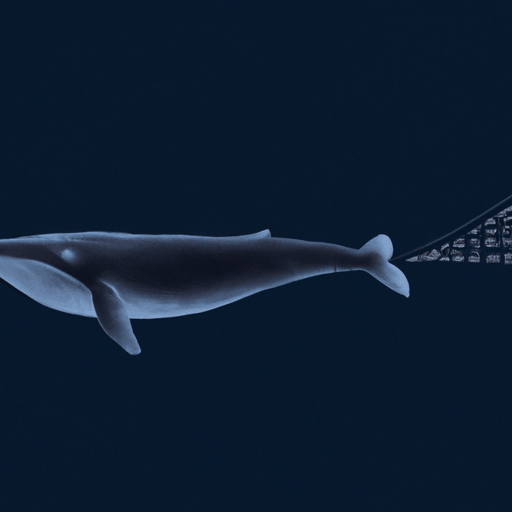

The crux of the issue lies in the involvement of a large COMP token holder, often referred to as a 'whale', who is pushing through a governance proposal. This proposal seeks to allocate $24 million in COMP tokens to a yield-bearing protocol known as goldCOMP. The whale's significant influence on the vote has led to apprehensions about the centralization of power and the potential manipulation of the system, which contradicts the fundamental principles of decentralized finance (DeFi).

The impact of these events has been noticeable in the market, with the price of COMP, the native token of Compound Finance, dropping by 6.7% after the supposed 'governance attack'. This sharp decline highlights the potential vulnerabilities in the DAO’s governance framework and has reignited discussions on how to safeguard against such occurrences in the future.

As the DeFi space continues to evolve, incidents like these underscore the need for robust governance mechanisms and the importance of maintaining decentralization. It remains to be seen how Compound Finance and other DAOs will address these challenges to ensure a fair and equitable system for all stakeholders.