Controversy Surrounding Tokenized Stocks Intensifies

By: Eva Baxter

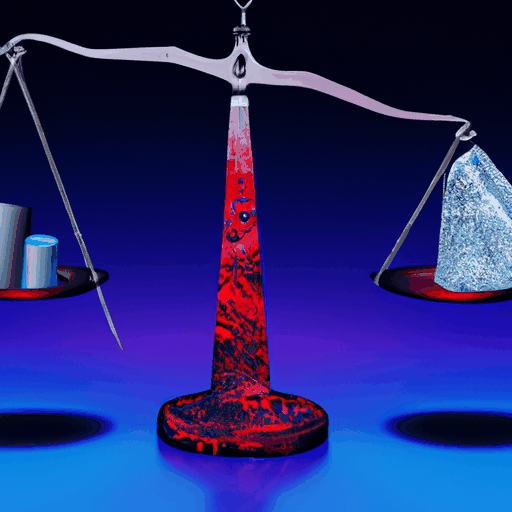

The concept of tokenized stocks, particularly those offered by platforms like Robinhood, has sparked a considerable amount of debate and controversy within the financial and crypto sectors. Robinhood’s venture into tokenized stocks has drawn criticism due to concerns about the lack of real equity backing and issues regarding transparency. Some claim that these tokenized versions of stocks, while innovative, fail to offer the tangible ownership and rights typically associated with owning stock shares in a company. This raises significant questions about the protection of investors and the authenticity of such financial products. One core criticism from prominent sectors is that these do not reflect true equity holdings, leaving investors potentially misled about what they actually own.

In a related context, the traditional finance industry is also voicing significant concerns over the regulatory framework surrounding tokenized stocks. The Securities Industry and Financial Markets Association (SIFMA), a leading trade group composed of securities issuers and finance firms, has formally urged the United States Securities and Exchange Commission (SEC) to reassess their stance on tokenized stock offerings. The SIFMA has emphasized that crypto companies should not be granted a special exemption or any form of no-action relief. This means that they recommend the SEC does not provide leeway for crypto firms to bypass standard securities law processes such as the notice and comment system. SIFMA argues for a more structured approach that's in compliance with existing securities laws to ensure that investor interests are adequately protected and that markets operate fairly.

The growing discourse around tokenized stocks points to the broader tension between traditional financial principles and the disruptive nature of blockchain-based financial products. While these tokenized instruments offer an innovative take on stock trading, they also present a challenge to regulators and traditional financial firms. The SEC's forthcoming decisions on this matter could set significant precedents; hence, it is under intense scrutiny from industry experts, regulators, and investors alike. As the situation develops, it is evident that finding a balance between innovation and regulatory compliance will be crucial for advancing tokenized financial products without compromising market integrity.