Crypto ETPs and Bitwise's Strategic Acquisition: A Market Overview

By: Isha Das

The cryptocurrency investment landscape has seen significant shifts recently, with varying performances among key players and strategic acquisitions reshaping the market. According to CoinShares' latest report, the trading volume for crypto exchange-traded products (ETPs) plummeted nearly 50% to $7.6 billion last week. Despite this downturn, there were still modest inflows amounting to $30 million. The market's response was primarily due to macroeconomic data indicating that the Federal Reserve was unlikely to reduce interest rates by 50 basis points in September.

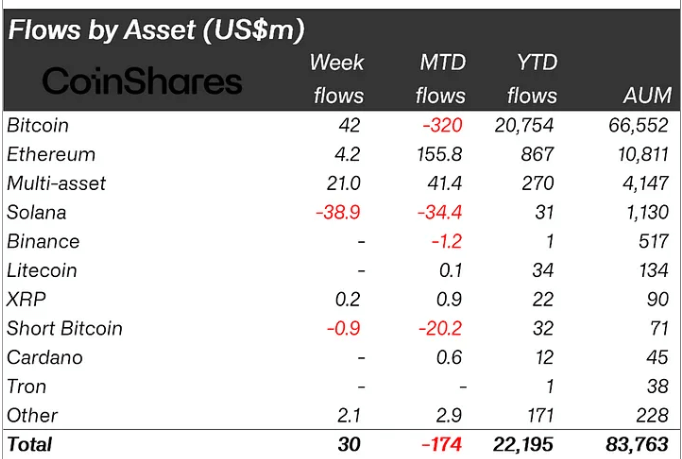

Bitcoin regained its dominance in the ETP market, attracting $42 million in inflows, although its month-to-date flow remains negative at $320 million. Ethereum continued its multi-week streak of inflows, recording $4.2 million, thereby bringing its total monthly inflows to nearly $166 million. Additionally, multi-asset products saw positive momentum with $21 million in inflows, while altcoins like XRP also reported gains. However, Solana experienced significant outflows, with $39 million exiting the asset, driven by declining network fundamentals and reduced memecoin trading.

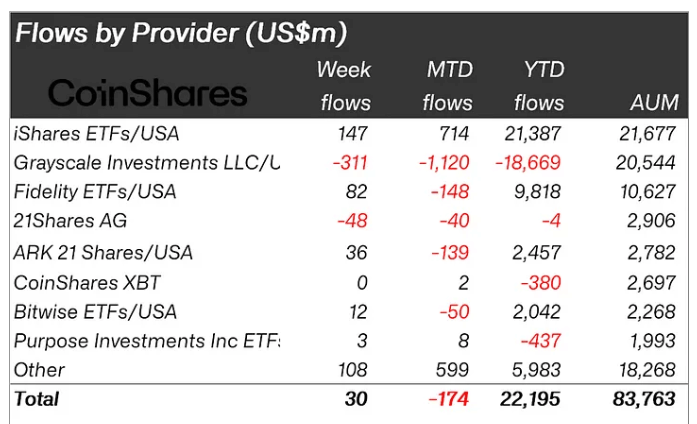

Meanwhile, the competitive landscape among ETP providers has been dynamic. Grayscale, a long-standing provider of Bitcoin and Ethereum ETFs, saw continued outflows amounting to over $300 million last week. This brought its total assets under management (AUM) down to $20.5 billion, with month-to-date outflows exceeding $1 billion. In stark contrast, new entrants like BlackRock iShares reported robust inflows, with BlackRock's ETF attracting $147 million last week and its AUM climbing to $21.677 billion, making it the sector's leader.

In a strategic move, Bitwise Asset Management has announced the acquisition of London-based ETC Group, a digital asset manager known for its physical Bitcoin ETP, BTCE. This acquisition propels Bitwise's AUM to over $4.5 billion and enhances its capability to serve European investors. The acquisition includes not only the BTCE but also the ET32 Ethereum staking ETP and the ESOL Solana physical ETP, expanding Bitwise's product offerings for clients globally. Hunter Horsley, CEO of Bitwise, emphasized the alignment of ETC Group's team with Bitwise's mission to help investors capitalize on opportunities in the crypto space.

ETC Group Acquisition: Key Benefits

The acquisition of ETC Group offers Bitwise several strategic advantages, strengthening its financial standing and market influence. It also allows Bitwise to leverage ETC Group's expertise and insights in the European market, where the latter is well-established with products domiciled in Germany. By integrating ETC Group's team, Bitwise gains valuable human capital to drive innovation and product development, positioning itself as a formidable player in the crypto asset management sector.

As reported by Bloomberg Law, the consolidation within the industry reflects a broader trend where firms seek to strengthen their competitive edge through strategic acquisitions. This move positions Bitwise as a more formidable player in the crypto asset management sector, capable of providing comprehensive and innovative solutions to meet the evolving needs of investors in the digital asset space.