Crypto Investment Products Surge to $46B, Institutional Interest in Bitcoin and Ethereum Grows

By: Eliza Bennet

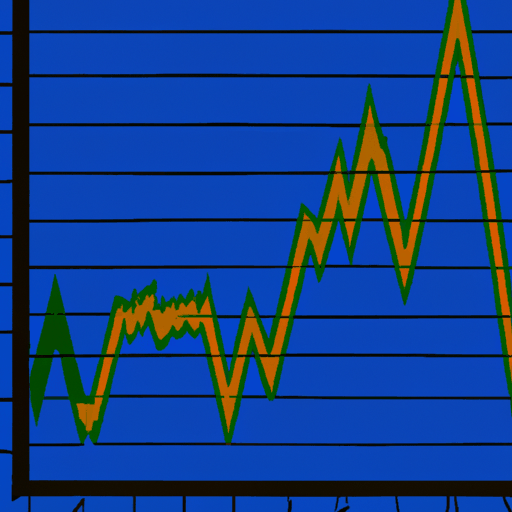

The total value of assets under management for crypto-related investment products has surged remarkably to $46.2 billion, marking a 107% increase. This leap was triggered by the tenth consecutive week of inflows these products have experienced, according to a weekly report. During the past week alone, crypto products recorded an inflow of $176 million, cumulatively summing up to $1.76 billion over the 10-week period.

Several factors contribute to this, including market optimism regarding the potential approval of a spot Bitcoin ETF in the United States. In recent months, established financial institutions, such as BlackRock, have submitted applications for a spot Bitcoin ETF to the Securities and Exchange Commission (SEC), sparking anticipation within the market.

Bitcoin and Ethereum have been beneficiaries of these inflows, with Bitcoin recording an substantial inflow of $133 million last week alone. Ethereum also continues to perform well, observing a notable inflow of $31 million last week, marking a five-week streak of $134 million. Conversely, Litecoin was the only digital asset to experience an outflow for the last week.

The influx was primarily driven by investors from Canada, Germany, and the U.S., while investors from the Hong Kong have contributed to a $15 million outflow from the market.