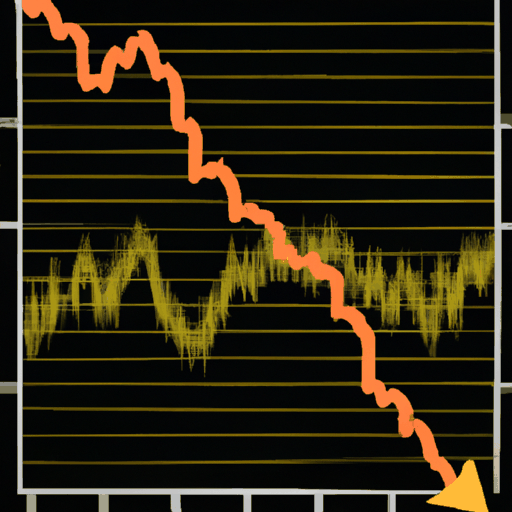

Crypto Investments Experience Unprecedented Outflows

By: Eliza Bennet

Quick Take

Recent data indicates a notable drop in investment enthusiasm among institutional investors as Bitcoin ETFs observed an outflow of $284 million last week, revealed by CoinShares. This bearish sentiment is framed by Bitcoin's ongoing unimpressive price action. As per the Farside data, US Bitcoin ETFs, including Invesco's Galaxy Bitcoin ETF (BTCO), Fidelity’s FBTC, and ARK’s ARKB, marked an outflow of $15.7 million on May 7. Additionally, Spot Bitcoin ETFs recorded outflows around $15.7 million. Significant outflows were seen from Grayscale's GBTC as it observed $28.6 million in outflows.

Susquehanna, a noteworthy trading firm, unveiled their Bitcoin ETFs exposure which extends beyond just GBTC. They have made strategic $1.3 billion investment in the US BTC ETFs out of which substantial $1.1 billion being commanded by the Grayscale Bitcoin Trust. Susquehanna also holds diverse investments in BTC related products including the Bitwise Funds Trust, ProShares Short Bitcoin (BITI), ProShares Bitcoin Strategy ETF (BITO), Valkyrie Bitcoin Futures Leveraged Strategy ETF, and the 2x Bitcoin Strategy (BITX). Coinciding with these outflows, Bitpanda has expanded its cooperation with Raiffeisen Bank, widening its crypto offering across 55 branches in Austria.