Crypto Market Faces Potential Turning Point Amidst Extreme Fear

By: Isha Das

Crypto markets are seeing one of their most subdued phases in years, with investor sentiment hitting historic lows. Analysts from Matrixport have suggested that the prevailing extreme fear could signal a crucial inflection point. Their analysis reveals that Bitcoin and other cryptocurrencies are reflecting what they term as a 'durable bottom,' where selling pressure might finally start to ease.

Matrixport's proprietary indicators, including the Bitcoin 'fear and greed index,' have shown a consistent pattern in the past where the 21-day moving average dropping below zero tends to mark a potential reversal. This pattern indicates that corrections in market sentiment could be due, especially when followed by significant drops as seen in June 2024 and November 2025. These instances, not guarantees of immediate recovery, nonetheless hint at periods where market mood rebounds, albeit temporarily, as some investors perceive these lows as buying opportunities.

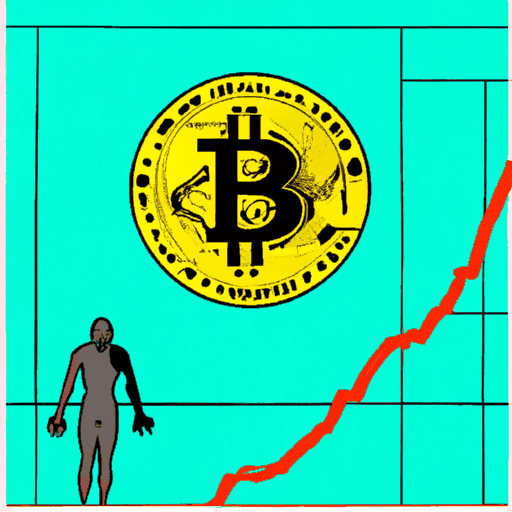

While current metrics are alarming, with the 'Fear and Greed Index' hovering near 10 out of 100, renowned financial services institutions like Hive underscore the potential for short-term bounces. Bitcoin's movement—rallying past $70,000 before retracing slightly to around $68,750—mirrors this volatility, with fluctuations stirred by external factors like US GDP data impacting crypto's risk profiles.

The potential exhaustion of selling pressure leads investors into two camps: those seizing today's low sentiment as an entry point, and those exercising caution until clearer trends manifest. Market heuristics like network metrics and institutional interest continue to embolden long-term holders, while short-term traders remain vigilant, opting for protective strategies. It remains crucial for investors to balance risk and be prepared for ongoing fluctuations.