Crypto Market Wraps up Q1 with Declining Hacks and High ETFs Inflow

By: Eva Baxter

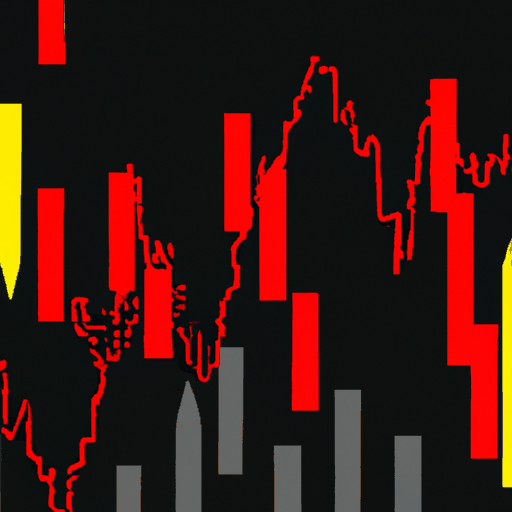

As the crypto market closes its first quarter of 2022, it experiences a significant decrease in protocol exploits or 'hacks', down by 23% in comparison to the same period last year. Blockchain security firms highlighted two major exploits in the closing week, the most prominent being a $11.6m exploit on Prisma Finance, an Ethereum liquid restaking platform, which led to the plummet of the mkUSD stablecoin value and the PRISMA token. Despite the value rebound, the total worth of locked assets in the protocol fell by 40% due to this exploit.

On the brighter side, Bitcoin is set to scoop record 7th-straight green month, consolidating around $70k. ETFs saw a $418m inflow while GBTC's outflow remained marginal. Strong investor interest is also evident from Fidelity's filing of an S1 form for ETH ETF, even as short sellers wager that the crypto rally won't persist.

In the regulatory landscape, The Department of Justice accused KuCoin of money laundering and oversaw $800m outflows post the charges. In a novel incident, the CFTC classified ETH and LTC as commodities. Simultaneously, Hong Kong appears set to accommodate 'in-kind' style ETFs. The months also saw AI coins surge, with FET hitting ATH amid merger rumors. FET, OCEAN, AGIX tokens are proposed at a $7.5bn FDV.