Ethereum and Bitcoin Prices Plummet Amid Bearish Sentiment

By: Eliza Bennet

Declining Funding Rates and Market Reaction

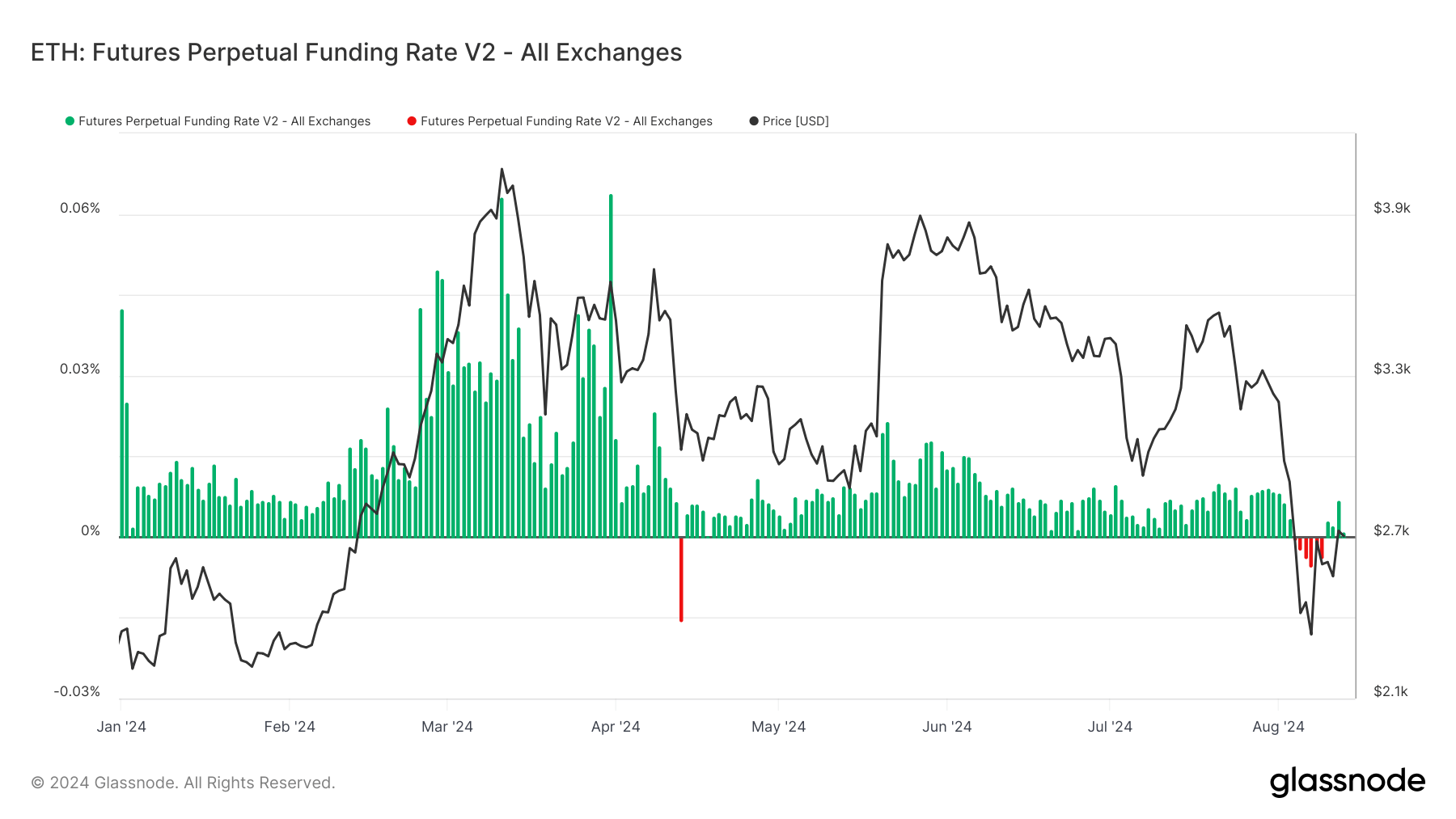

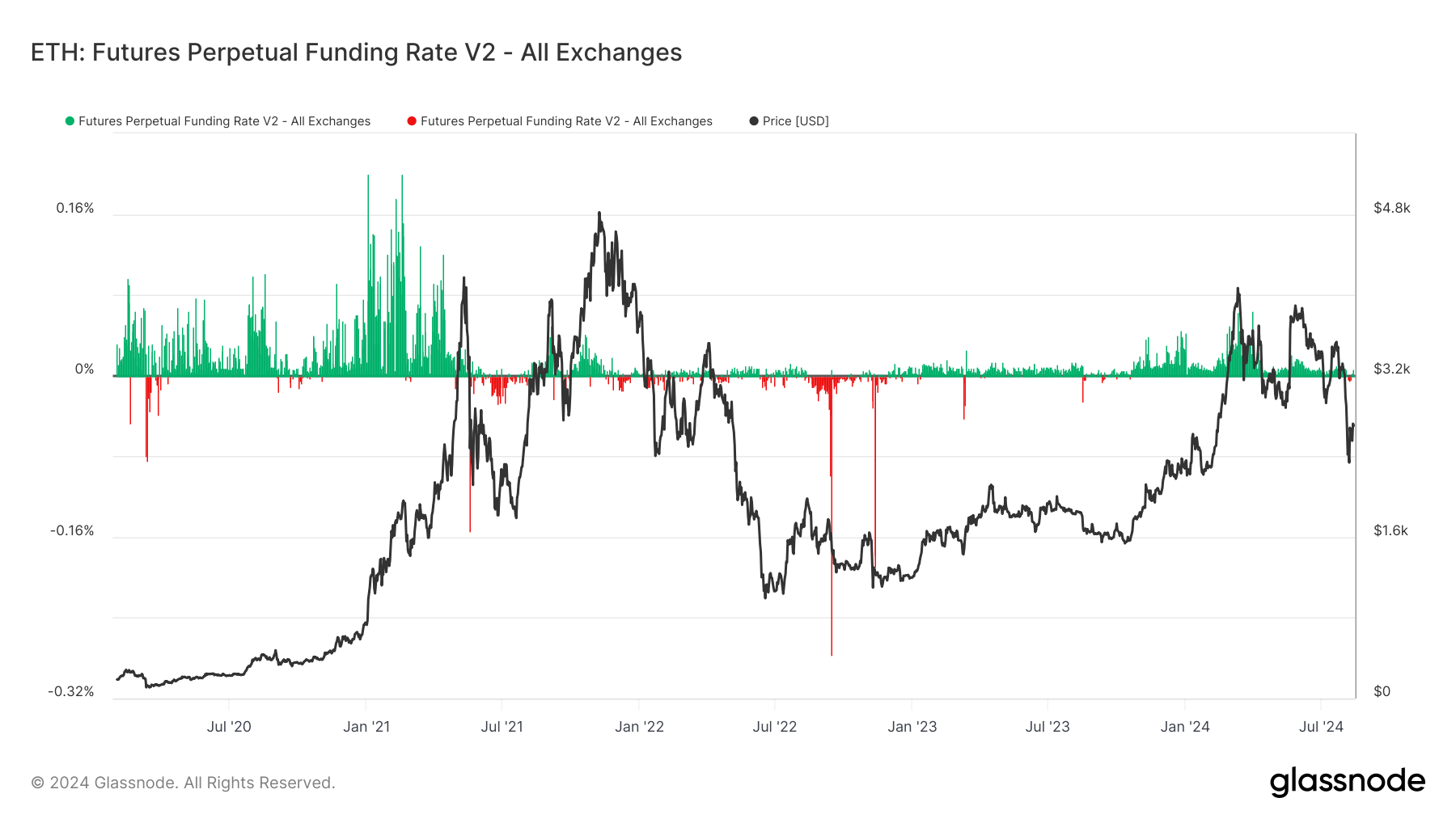

Recent Trends: Ethereum's perpetual futures funding rate has experienced a significant dip, indicating a shift in market sentiment towards bearishness. Historically, when funding rates turn negative, it suggests that bearish bets are dominating, as short positions pay long positions.

This trend mirrors broader market conditions. In periods of optimism, like the 2021 bull run, funding rates soared positively as traders expected prices to continue climbing. Conversely, during market downturns in mid-2022 and various points in 2023, rates turned negative, depicting bearish sentiment. The current scenario, with rates dipping below the $2,700 level, signals another bearish shift.

Consumer Price Index Impact

The broader cryptocurrency market, including Ethereum and Bitcoin, has reacted negatively following the release of the Consumer Price Index (CPI) report. Despite inflation dropping in line with economists' expectations, the market has cooled.

Market Liquidity: The sudden decline in Bitcoin and Ethereum prices has also been influenced by liquidations exceeding $175 million. This rapid sell-off of long positions has exacerbated the downtrend, leading to increased volatility. Even as traditional stock markets show gains, the crypto sector struggles, highlighting the contrasting dynamics between these financial spheres.

Conclusion

The interplay between funding rates and market sentiment amid fluctuating economic indicators highlights the complexity of the crypto market. Traders and investors must navigate these challenges, balancing optimism with caution to manage their positions effectively in a highly volatile environment. As the market continues to digest economic reports and react to liquidation trends, close monitoring and strategic planning are essential for navigating the current crypto landscape.