Ethereum Sentiment Signals Potential For New Rally

By: Isha Das

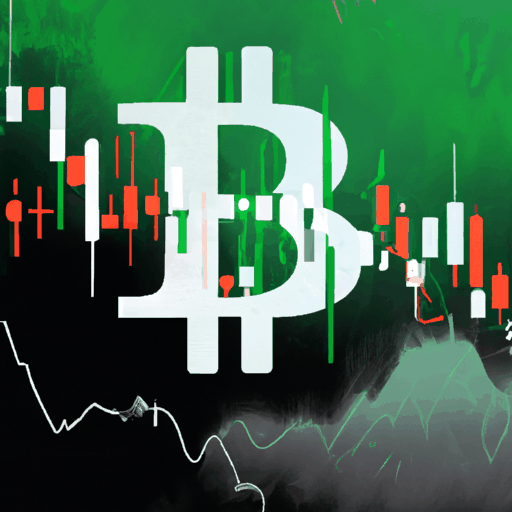

Ethereum's current social sentiment levels are drawing attention as they mirror the conditions seen before its previous major rally, according to Brian Quinlivan from Santiment. The sentiment is currently at low levels similar to those experienced before Ethereum's price surge in 2025, which led the cryptocurrency back to its 2021 all-time high. Quinlivan highlighted that the declining social media chatter suggests a potential for market turnaround, as historically, such periods have often preceded price rebounds.

On August 23, Ethereum climbed to a new all-time high of approximately $4,900 shortly after recovering from a yearly low of $1,470 in April. This rally reinstated Ethereum's standing above its earlier peaks from 2021. However, since that peak, Ethereum has seen a fall of about 36%, currently trading around $3,089. A significant contributing factor to this decline was a mass liquidation event on October 10, which resulted in an approximate $20 billion loss across the crypto market.

The broader market sentiment has also been influenced by recent market volatility, with fear indicators reaching lows. A recent index showed a Fear score of 29, while the Altcoin Season Index read 34 out of 100, suggesting a stronger flow of funds into Bitcoin compared to altcoins over the past 90 days. Meanwhile, on-chain activity on the Ethereum network continues to show promising signs, with increased user interest in staking and other network activities.

Technological advancements have been a focal point of discussions within the Ethereum community, especially with Vitalik Buterin's comments on the Fusaka upgrade, PeerDAS, and the promise of zero-knowledge proofs and sharding to improve Ethereum's throughput. While institutional investors, according to Anthony Bassili from Coinbase Asset Management, generally rank Ethereum as a core asset next to Bitcoin, indicating its perceived stability in portfolios.