Former Cred Executives Admit to $150M Crypto Fraud

By: Isha Das

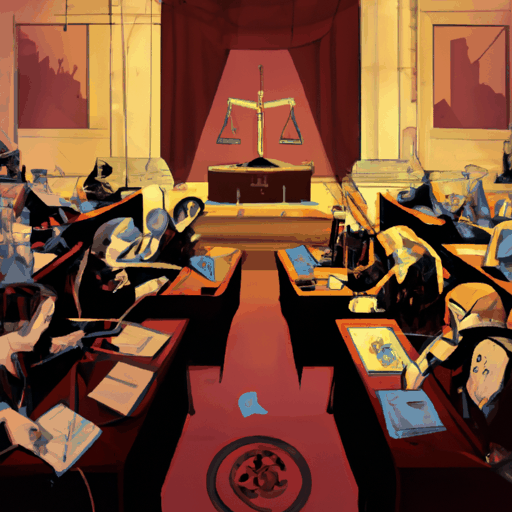

In a recent legal case that has captured significant attention in the cryptocurrency community, two former executives from the now-defunct crypto lending platform Cred have pleaded guilty to wire fraud. The individuals in question are former CEO Daniel Schatt and former Chief Financial Officer Joseph Podulka, both of whom have acknowledged their roles in misleading customers about the company's precarious financial situation prior to its collapse. These admissions were part of a plea agreement reached with prosecutors.

The case details were formally recorded in a California District Court, with District Judge William Alsup presiding. As a part of the legal proceedings, Schatt and Podulka agreed to plead guilty to charges of wire fraud. The fraud charges stem from activities leading up to Cred's financial downfall, which erased millions of dollars in cryptocurrency deposits from their customers. The two former executives misled stakeholders about the true financial health of the company, prompting further scrutiny into the practices of crypto lending platforms. Sentencing for Schatt and Podulka is scheduled for August 26, and they could face penalties including up to 20 years in prison and substantial fines, reflecting the severity of their offenses.

The collapse of Cred not only affected individual investors but also raised broader concerns about the transparency and regulatory oversight of crypto lending platforms. The case against Schatt and Podulka underscores the critical need for regulatory frameworks in the rapidly evolving cryptocurrency market. The situation serves as a cautionary tale for both customers and operators within the crypto space, illustrating the potential pitfalls of inadequate disclosure and the mishandling of funds.

This high-profile case has further ignited debates about the future of cryptocurrency regulation. Industry leaders and policymakers are being urged to implement more stringent guidelines to protect investors and maintain the integrity of the market. As cryptocurrencies continue to grow in popularity and adoption, ensuring transparency and accountability will be vital in fostering trust and stability in the digital financial system.