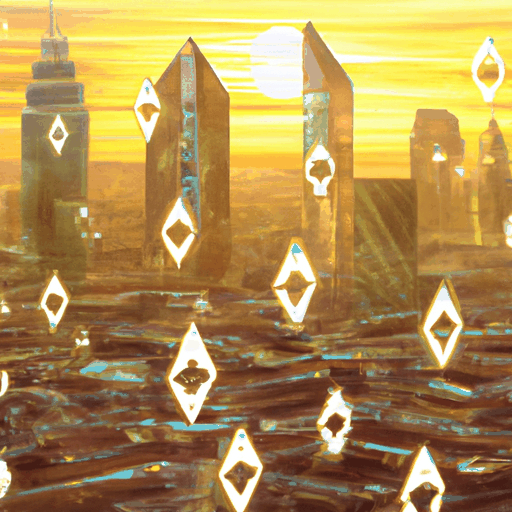

Hong Kong's ASPIRe Regulatory Framework for Crypto

By: Eva Baxter

Hong Kong has marked a significant milestone in its journey to becoming a global crypto hub by introducing an ambitious regulatory framework, known as the ASPIRe roadmap. This framework is crucial for setting robust standards in the digital asset sector, and it positions Hong Kong as a leading player in the global crypto market, which is projected to be valued at over $3 trillion in 2024.

The ASPIRe framework is structured around five core pillars: Access, Safeguards, Products, Infrastructure, and Relationships. It is designed to address the complexities of digital assets by streamlining market entry protocols, enhancing investor protection, and ensuring operational transparency. In a detailed document by the Securities and Futures Commission (SFC), twelve initiatives are proposed to simplify licensing for over-the-counter trading and custody services, upgrade storage and technology requirements, and clarify product classification. These measures are expected to boost both institutional and retail participation in the evolving market.

The framework's commitment to the principle of 'same business, same risks, same rules' has already resulted in the licensing of nine platforms, with more applications under review. Key to this plan is the adoption of technology-neutral, outcome-based standards, as well as the adaptation of insurance and compensation frameworks to manage operational risks, thereby reducing barriers for liquidity providers.

Beyond regulatory efforts, Hong Kong's crypto leadership ambitions are further highlighted through its active participation with international regulatory organizations such as IOSCO and the Financial Action Task Force. A collaborative venture involving Standard Chartered, Animoca Brands, and HKT to launch a stablecoin pegged to the Hong Kong dollar signifies Hong Kong's innovative spirit in stablecoin development.

The initiatives are timely and align with global trends toward unified regulatory standards. Critical components of these initiatives are a strong focus on investor education, improved onboarding processes, and enhanced cross-agency collaboration to monitor and mitigate market risks. This comprehensive regulatory overhaul aims to bolster investor confidence and secure Hong Kong's position as a key global player in the crypto arena.

For further details, you can view the full article here.