Investors Flee Grayscale Bitcoin Trust Amid Rising Spot ETF Popularity

By: Eva Baxter

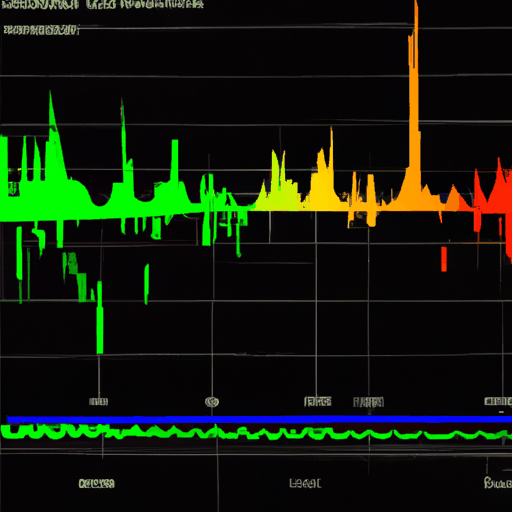

Grayscale Bitcoin Trust (GBTC) has seen staggering net outflows reaching $1.18 billion. At the same time, other US spot bitcoin ETFs have witnessed a significant influx of capital worth $2 billion. Analysts attribute the reversal to the lower costs associated with other funds, particularly the newly introduced spot-based ETFs.

Simultaneously, GBTC has noted substantial transfers of Bitcoin to Coinbase. Since the launch of the spot-based ETFs, these transactions, valued at around $800 million, suggest possible redemption activity on Grayscale's part, as investors shift into lower-fee ETFs.

These funds are likely being used as liquidity for any potential inflows into other Bitcoin ETFs, with Coinbase Prime playing a crucial role across multiple spot Bitcoin ETFs. The outflows from the Grayscale Trust are speculated to influence Bitcoin's price in the near future.

While other Spot Bitcoin ETFs have witnessed increased trading activity, with almost $10 billion volume in just three days, Grayscale’s GBTC has seen significant outflows due to the fund’s higher expense ratio of 1.5 percent, making it the most expensive Spot Bitcoin ETF in the United States.