Learn Concept: Cross-Chain Liquidity Protocols

By: Eva Baxter

As the cryptocurrency ecosystem grows increasingly diverse, the need for seamless interoperability and liquidity across different blockchain networks becomes ever more critical. Enter cross-chain liquidity protocols, an innovative solution designed to bridge isolated blockchain ecosystems.

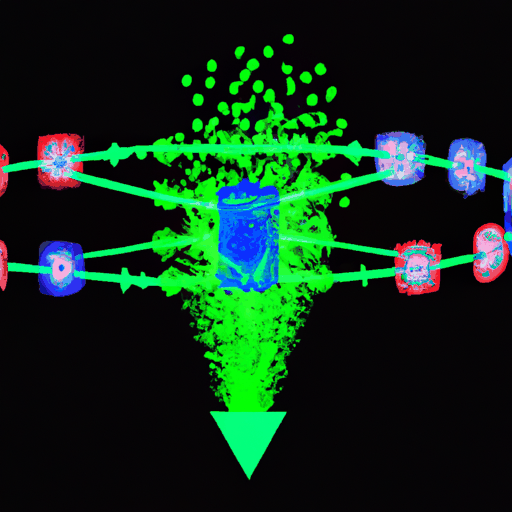

Cross-chain liquidity protocols enable assets to be transferred and traded across various blockchains without stopping at a centralized exchange. By utilizing smart contracts and decentralized liquidity pools, these protocols ensure high-speed transactions and lower fees while maintaining transparency and security.

One significant benefit of cross-chain liquidity protocols is their ability to reduce market fragmentation, uniting liquidity from multiple chains. This creates a more cohesive ecosystem where users can trade, lend, and borrow assets effortlessly. Popular examples of such protocols include Protocol A and Protocol B.

As DeFi continues to innovate, cross-chain liquidity protocols sit at the frontier of blockchain interoperability, driving the next wave of decentralized financial applications and providing robust solutions for future blockchain advancements.