Learn Concept: How Bitcoin ETFs Impact its Price and Institutional Interest

By: Eliza Bennet

Bitcoin exchange-traded funds (ETFs), financial products traded on stock exchanges that track the performance of Bitcoin, have been garnering significant attention lately. This concept is important for advanced crypto users to understand as ETFs play a notable part in Bitcoin’s current value growth as well as the surging institutional interest.

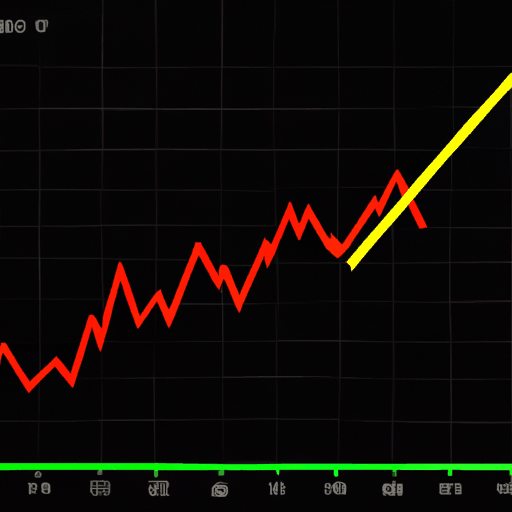

Bitcoin’s recent price surge past $71,000 is not a random uptick, but a result of various factors including the introduction of spot Bitcoin ETFs. Since their debut in January, these ETFs have accumulated a massive number of Bitcoin holdings as well as a tremendous trading volume exceeding $100 billion. Major ETFs such as BlackRock’s iShares Bitcoin Trust ETF and Fidelity’s Wise Origin Bitcoin Trust hold approximately 4% of all circulating BTC.

The growth in the Ethereum and Bitcoin ETF applications being submitted to the London Stock Exchange (LSE) indicates a significant leap towards the mainstream acceptance of cryptocurrencies in financial markets. Furthermore, the upcoming Bitcoin halving event and Tether's (USDT) recent capital influx also contribute to the Bitcoin rally, pointing to an increasing alignment between cryptocurrencies and traditional financial systems.

Understanding the workings and effects of Bitcoin ETFs can give advanced crypto users insightful tools to navigate the market dynamics and shifts. Being knowledgeable about these products can open up avenues for educated speculation and risk mitigation in the unpredictable world of cryptocurrencies.