Learn Concept: Understanding Bitcoin's Volatility and its Effects on Crypto Market

By: Eliza Bennet

Key Insights

The crypto market is highly volatile and recently we observed that when Bitcoin prices fell below the $39,000 mark, causing significant withdrawals in the ongoing cycle. This not only affected the value of Bitcoin but also caused significant liquidations across the cryptocurrency market, specifically on long positions. Such market turmoil also affected crypto-related stocks, with reductions noticed in values of companies like Coinbase and MicroStrategy.

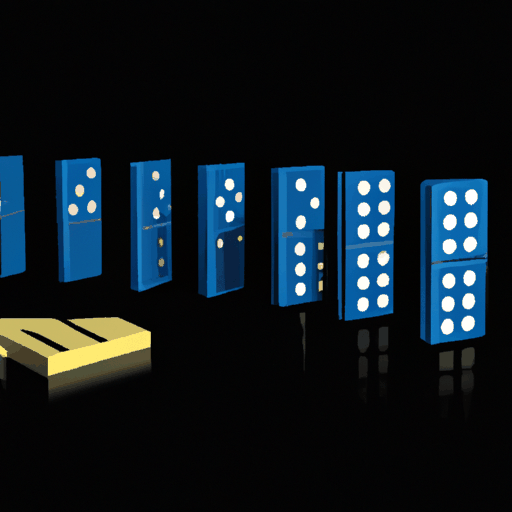

The learning from this news is that Bitcoin's value doesn't only affect individual holders of the cryptocurrency, it has a far-reaching impact over the entire crypto market and on stocks of crypto related companies. Traders and investors need to be cautious of this domino effect while dealing with digital assets.

In the future, any fluctuation in Bitcoin value can be anticipated to have similar impacts. It's also interesting to note that other market factors such as the launch of new exchange-traded funds can also lead to revisions in shares of crypto companies, as happened with Coinbase.

Bottom Line: The crypto market is interconnected. Changes in one aspect can lead to a chain reaction. This creates a need for comprehensive market understanding before investing in digital assets or crypto related stocks.