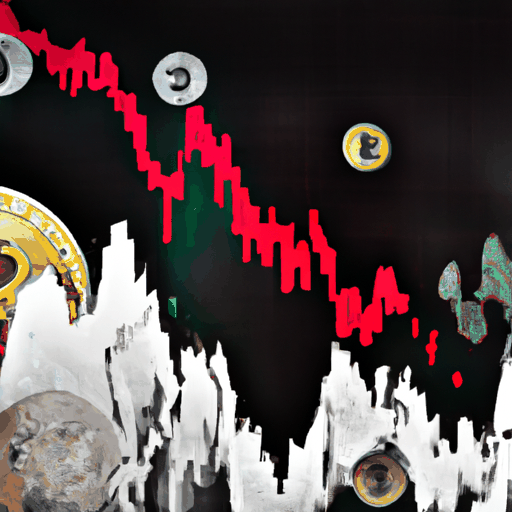

Market Turmoil: Fake Tariff News Creates Crypto and Equity Whipsaw

By: Eva Baxter

The financial markets experienced a rollercoaster ride recently, as unverified news about a potential 90-day pause in US tariffs sent shockwaves through both equity and cryptocurrency sectors. Reports emerged from a verified social media account falsely claiming that a tariff pause was under consideration by the US administration, initially causing a bullish surge in risk assets. This misinformation quickly gained traction, although it was later refuted by the White House, confirming it as "fake news."

Experts observed that the surge and subsequent correction highlighted the underlying volatility and sensitivity of both traditional and digital markets to policy-related speculations. At its peak, the rumor-driven rally added over $3 trillion to the S&P 500's market cap and Bitcoin saw a dramatic climb from around $75,805 to over $81,200 within minutes. However, this bullish sentiment proved transient as the misinformation was debunked, leading to a rapid shedding of those gains. By the time the situation stabilized, the S&P 500 had nearly erased all its gains, demonstrating the extreme impact of speculative trading on market stability.

In the wake of these events, commentators in the crypto sphere highlighted the significant amount of sidelined capital waiting for positive developments. Analysts noted that such situations could serve as precursors to potential rallies, particularly if credible positive news were to emerge. There were further discussions suggesting that the incident had underscored the current cycle's largest drawdown, comparable to past market corrections.

The incident also sparked a dialogue about the preparedness of financial infrastructures to handle sudden influxes of market activity instigated by news, whether accurate or fabricated. Across the pond, European officials reiterated their commitment to negotiate with the US to mitigate such economic uncertainties, proposing collaborative tariff solutions. This illustrates a global effort to ensure economic stability amid fluctuating financial markets.