Massive Balancer Exploit Shakes DeFi Trust: $128 Million Stolen

By: Eva Baxter

The decentralized finance (DeFi) ecosystem was jolted by a massive exploit involving Balancer, a widely respected protocol, which suffered a staggering theft of $128 million. This incident has highlighted significant risks within the DeFi sector and raised questions about security measures in place. According to blockchain security firm PeckShield, the breach primarily affected Balancer's operations on the Ethereum blockchain, resulting in losses of approximately $100 million. Other platforms like Berachain, which ceased operations temporarily to stem the consequences, lost about $12.9 million. Smaller chains, including Arbitrum, Base, Sonic, Optimism, and Polygon, also faced substantial thefts. Balancer quickly acknowledged a potential exploit affecting its version 2 pools and immediately launched an investigation to identify the exploit's specifics while urging users to secure their assets.

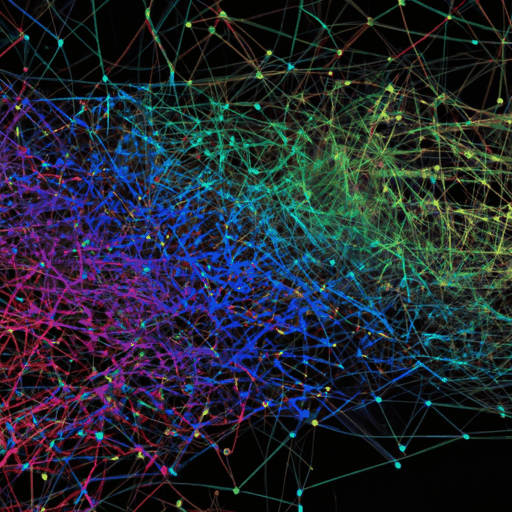

Investigations led by Phalcon, another blockchain security firm, revealed that the exploit stemmed from the exploitation of Balancer Pool Tokens (BPT). The attacker manipulated the logic used to calculate pool prices during batch swaps, allowing them to create an artificial imbalance in the internal price feeds. This manipulation enabled unauthorised withdrawals of tokens before the system could correct itself. Crypto analysts identified that improper authorization and callback handling were tools used by the hacker to bypass existing safeguards, enabling rapid asset drainage across interconnected pools. The interconnected and composable vault architecture of Balancer exacerbated the problem, amplifying the exploit's effects across the network.

The attack has had far-reaching implications for DeFi, eroding trust in previously secure platforms. Balancer, which had been considered a conservative and stable venue due to multiple audits and a long-standing track record, now faces a crisis of confidence. This incident underscores the DeFi landscape's inherent risks, where smart contract vulnerabilities can lead to significant losses despite extensive audits. As the third-worst DeFi breach of the year, it has prompted a renewed call for more robust risk management infrastructure and may well accelerate regulatory scrutiny, as efforts are underway to introduce a legal framework governing DeFi protocols.

The psychological impact of this hack is profound. It not only highlights the need for meticulous vetting of smart contracts but also suggests an environment where even well-audited platforms are prey to technological lapses. As institutions and individual investors reconsider their trust in decentralized systems, there is an urgent call within the industry to focus on developing more rigorous security measures and risk assessment strategies. The incident serves as a potent reminder of the dual nature of composability in DeFi – fostering innovation yet expanding systemic risk.