Metaplanet Surges with Additional Bitcoin Acquisition Amid Market Rebound

By: Eva Baxter

Metaplanet's Aggressive Bitcoin Strategy

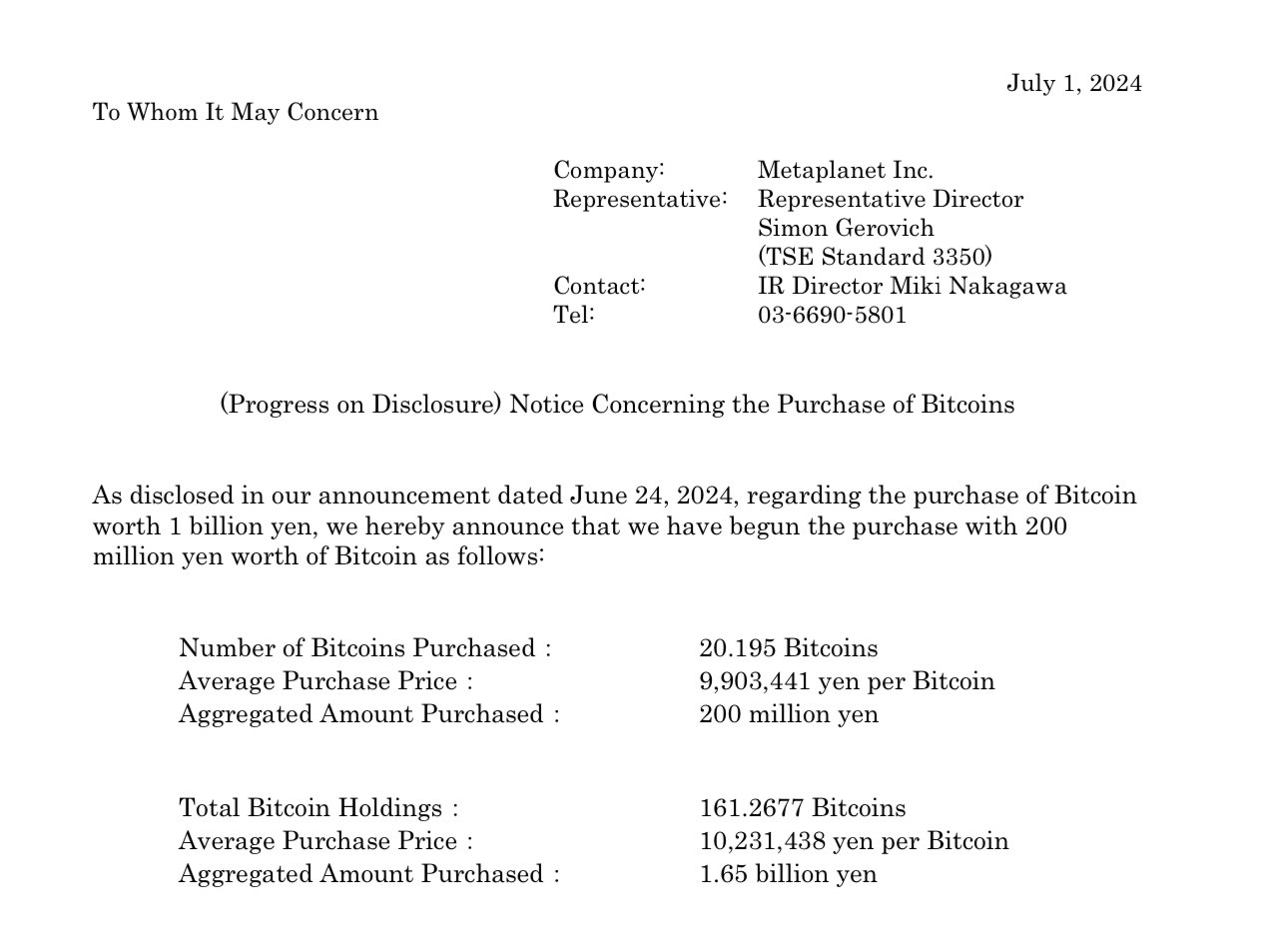

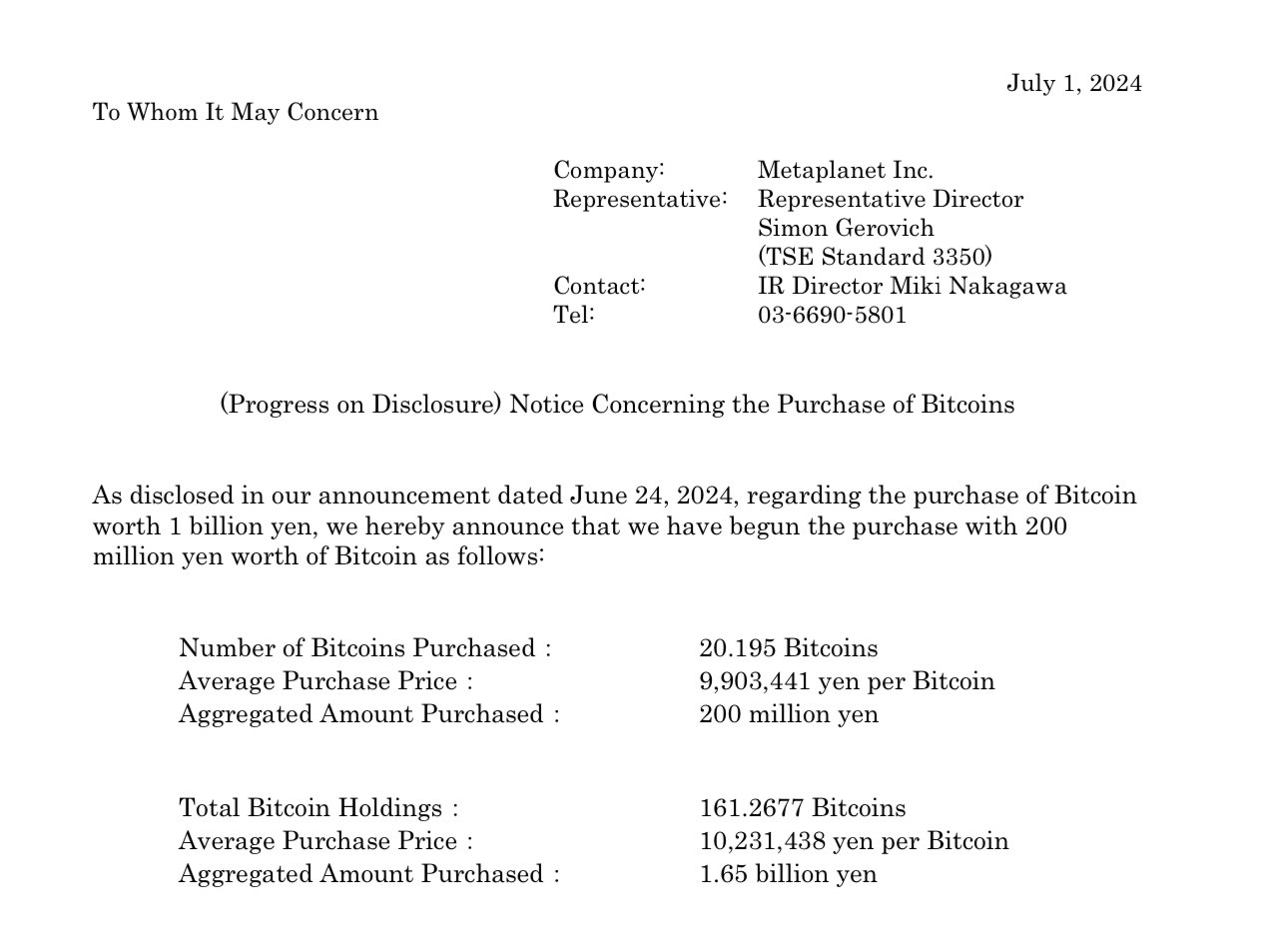

On July 1, Metaplanet announced a significant purchase of 20.195 Bitcoin, which increased its total Bitcoin holdings to 161.26 BTC. This acquisition comes at a time when Bitcoin prices are on the rise, with the cryptocurrency recently surpassing the $63,000 mark. Metaplanet expended a sum of 200 million yen ($1.24 million) on this latest acquisition, paying an average of 9,903,441 yen ($61,506) per Bitcoin.

The addition to its Bitcoin reserves is in line with Metaplanet's broader investment strategy. Just a week before this purchase, the company revealed its intention to issue 1 billion yen worth of bonds (equivalent to approximately $6.26 million) to support further Bitcoin acquisitions. For further detail on their bond issuance plans, you can visit Tokyo Stock Exchange.

With this latest acquisition, the average purchase price for Metaplanet's Bitcoin holdings has risen to 10,231,438 yen ($63,543). Their total investment now stands at 1.65 billion yen. This move has bolstered Metaplanet's share price, which saw a 1% increase today. Over the course of the year, the company's shares have soared by 525%, indicating strong market confidence in their Bitcoin-centric strategy.

Market Context and Strategic Timing

This strategic acquisition coincides with a robust rally in the Bitcoin market. Metaplanet's timing appears to be capitalizing on the current market dynamics, where Bitcoin is once again gaining momentum. This growth trajectory is also reflected in broader market indicators, such as the weakening Japanese yen, which is currently trading at 161 against the US dollar. This currency trend provides additional financial leverage for dollar-denominated investments like Bitcoin.

For those interested in the detailed analytics of BTC and USDJPY trends, you may refer to TradingView.

Future Prospects

Metaplanet's strong financial moves indicate a commitment to leveraging Bitcoin as a significant asset class. This aggressive strategy not only signals confidence in Bitcoin's future prospects but also sets a precedent for other institutional investors. As the year progresses, it will be intriguing to observe how Metaplanet further navigates and capitalizes on the cryptocurrency landscape.