MYX Token Sees Remarkable Surge, Triggering Market Impact

By: Isha Das

In a surprising burst of activity, MYX, the native token of MYX Finance, has experienced a significant rise, rocketing more than 200% over the past 24 hours. This dramatic increase in value has made it the top gainer as of September 9, according to the latest market data. The token's rapid ascent saw its price leap from approximately $6.28 to a high of $17.75, propelling its market capitalization above $2.1 billion. This leap places MYX among the top 50 cryptocurrencies and elevates its fully diluted valuation to over $17.7 billion, a position within the top 30 largest digital assets.

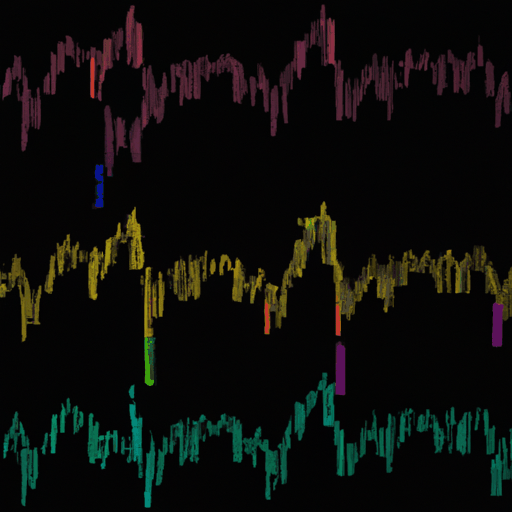

The dramatic price surge of MYX has sparked a series of liquidations, marking the largest wave in the crypto market recently. CoinGlass data indicates that short traders, who bet against the MYX token, faced losses amounting to $48.7 million. This figure surpasses the liquidations seen in major cryptocurrencies such as Ethereum, which stood at $48.5 million, and Bitcoin at $39 million. A notable increase also accompanied the price surge in derivative trading volumes, climbing over 100% to exceed $11 billion, ranking MYX within the top five most traded tokens within the last 24 hours.

Despite the token’s impressive performance and increased trading volumes, the swift escalation has led to skepticism in some quarters. Market observers have expressed concerns about the sustainability of the demand, with some attributing the token's spikes to potential market manipulation. There are suspicions of targeted squeezes that artificially inflate MYX's value, facilitating the liquidation of certain trading strategies and consolidating market control in limited hands.

On the other hand, some believe that the recent bullish trend reflects genuine interest in decentralized perpetual exchanges, drawing parallels to similar successes in the industry. MYX Finance operates a decentralized perpetual exchange on the BNB Chain, leveraging a unique Matching Pool Mechanism to manage slippage and support multi-blockchain trades. The platform reportedly caters to over 177,000 traders, handling a lifetime trading volume of about $95.6 billion. The surge in MYX's value could signal a growing appetite for decentralized finance solutions, though the market's future movements remain to be closely monitored.