Navigating Record Hash Rates and AI Competition in Bitcoin Mining

By: Eva Baxter

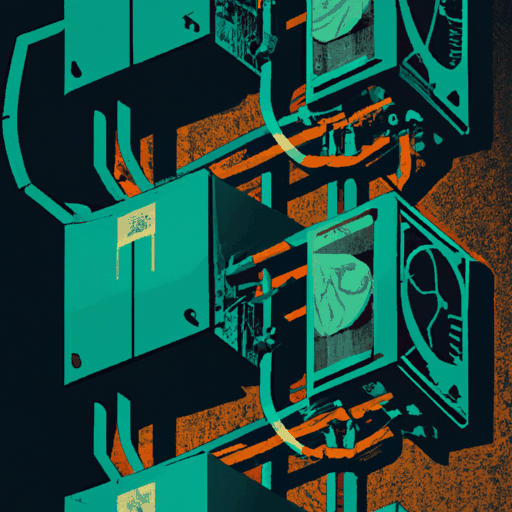

Bitcoin mining is at a critical juncture, encountering novel challenges and opportunities as hash rates and mining difficulties soar to new peaks. The network's difficulty has reached an all-time high of 136.04 trillion, translating to $52 per petahash per day. This landscape requires miners to reassess strategies, as forward markets project a hashprice decline to approximately $49.17 per petahash per day over the next six months. In response, many are exploring high-performance computing revenue avenues linked to artificial intelligence as a buffer against rising electricity costs and limited scalability.

Miners must adeptly navigate gross margins while managing power dynamics, as seen with strategic moves by firms like CoreWeave in their significant acquisition of Core Scientific. Additionally, trends such as operational curtailments during Texas’ Four Coincident Peak season highlight cost management's importance, spurring temporary hashprice hikes. As AI demands increase, AI colocation and managed GPU services offer viable revenue streams, demonstrated by TeraWulf's over $3.7 billion expected hosting revenue. Despite challenges like retrofitting existing operations, stable rental prices in AI colocation influence treasury strategies as showcased by Iris Energy. Understanding these shifts and balancing Bitcoin mining with AI operations will shape the industry's dynamic future.