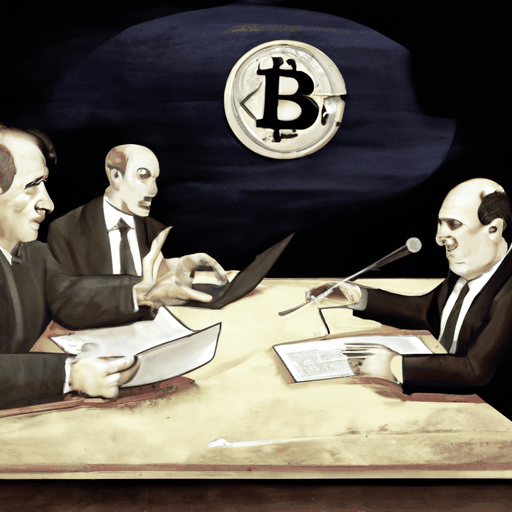

Political Rift Over Trump's Bitcoin Reserve Plans Persists

By: Isha Das

The emerging debate on cryptocurrency within the U.S. government has intensified, as calls grow for the U.S. Treasury to halt efforts by the Trump administration to establish a cryptocurrency reserve. Representative Gerald E. Connolly from Michigan has voiced significant concerns, highlighting potential conflicts of interest linked to President Donald Trump and questioning the merits of such a financial strategy for the American public.

Connolly's criticism, notably addressed in a formal letter to Treasury Secretary Scott Bessent, argues that the proposed strategic cryptocurrency reserve is ostensibly designed to benefit Trump and his associates rather than serving the national interest. He points out that these plans exhibit no tangible advantages for U.S. citizens and may represent a risky fiscal endeavor by favoring select digital currencies.

This initiative comes amid macroeconomic volatility that has kept Bitcoin at a critical juncture. Despite favorable indications emanating from the White House supporting cryptocurrency asset reserves, the prevailing economic uncertainties and legal disputes echo through the financial corridors. Economic policymakers remain widely divided on whether the U.S. should pivot towards a more cryptographically-secured form of monetary storage.

The conversation surrounding cryptocurrency adoption continues to foresee the interplay of political strategy and financial ethics. While some government sectors perceive value in diversifying monetary reserves with digital assets, others, exemplified by Rep. Connolly, challenge the prioritization of such policies, urging for scrutiny regarding their broader implications.