Publicly Traded Bitcoin Miners Reduce Sell-Offs, Strengthening Market Position

By: Eliza Bennet

Market Dynamics Shift in Bitcoin Mining

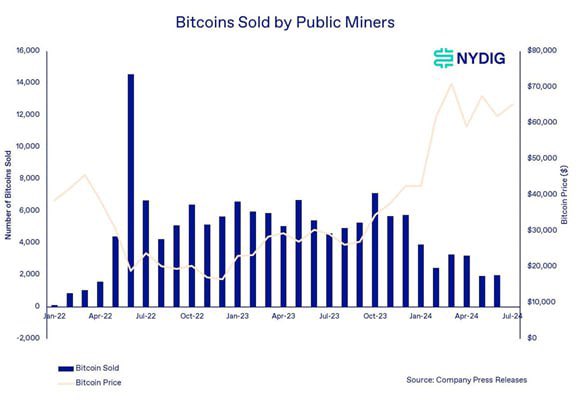

In a recent analysis by Kelly Greer, an analyst at Galaxy, data from NYDIG highlights a significant shift in the behavior of publicly traded Bitcoin miners over the past two years. These miners have transitioned from net sellers to net buyers of Bitcoin, a development that could have profound implications for the cryptocurrency market.

Companies such as Marathon Digital Holdings (MARA) have remarkably increased their Bitcoin holdings, surpassing 20,000 BTC, as reported by minermag.“Public BTC miners flipped from net sellers to net buyers in July,” said Greer, pointing out the importance of this trend.

Long-Term Market Implications

This shift is particularly significant given the substantial portion of the Bitcoin network's hash rate controlled by these publicly traded miners, a trend anticipated to continue as larger players assert their dominance. Although public miners as a group are not yet significant net buyers, the reduction in sell pressure is a positive development for the overall market. Reducing the amount they sell helps to stabilize Bitcoin prices and support growth in the long term. Leaders in the sector like Marathon Digital are setting a precedent that could lead to broader changes.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/P5SHB63AIJL4BOP2TNHUTI23EY.jpg)

Public Listing Benefits

According to a recent report from Bernstein, publicly traded Bitcoin miners have an upper hand over their unlisted counterparts due to their ability to raise debt or equity in some of the world's deepest capital markets. This access to capital provides a significant advantage, enabling listed companies to expand operations, invest in new technologies, and better weather market volatility. The report emphasizes that financial flexibility afforded by being publicly listed helps these companies to strategically hold onto their Bitcoin, instead of selling it during periods of price stress.

The evolution from sellers to holders not only underscores the growing confidence among these miners but also signals a potential trend where Bitcoin may face less market pressure, paving the way for more stable price movements. As larger firms consolidate their market presence, the strategic shifts observed could play a crucial role in Bitcoin's market dynamics moving forward.