Sam Bankman-Fried Hints at Sudden $8B Shortfall in His Therapeutic Trial

By: Eliza Bennet

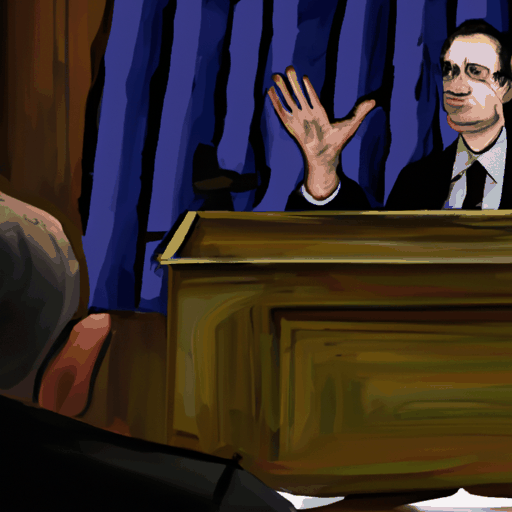

In his high-profile fraud trial, Sam Bankman-Fried, the previously distinguished cryptocurrency personality, who is currently mired in a criminal trial, unveiled new revelations. The trial, which has quickly become one of the most riveting phenomena in the crypto industry, saw the ex-billionaire testifying to a sudden $8 billion shortfall that led to the collapse of FTX and Alameda Research.

Beginning his testimony as the golden boy from crypto's better days, he ended more imperiled than ever before. During this extended trial, he has faced intense scrutiny and cross-examination from the jury and prosecution. According to Bankman-Fried, the shortfall came as a blindsiding shock, gradually uncovered over time, sparking grave concern over its potential graver ramifications.

Despite the trying circumstances, Bankman-Fried eagerly shared significant insights into FTX and Alameda's inner workings, from their strategic financial practices to the steps taken to protect user funds from unauthorized withdrawals. Still, the trial has underscored the tumultuous, chameleonic nature of the crypto realm, reminding investors and players alike to navigate these waters with foresight and diligence.

The proceedings are meant to continue into November, with Bankman-Fried to continue his testimony. Critics and spectators alike reckon that this case could eke out a verdict that significantly influences the labyrinthine landscape of cryptocurrency.