Sudden Growth in Solana's DeFi Ecosystem and Launch of 'Nyan Heroes' on Epic Games Store

By: Eva Baxter

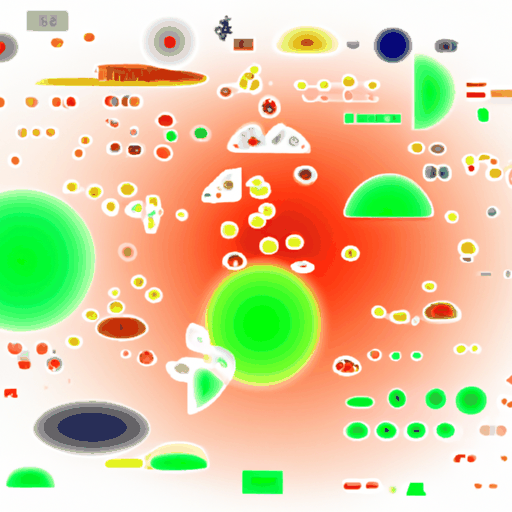

Solana has evolved significantly as a major player in the decentralised finance (DeFi) market, with its total value locked (TVL) standing at $4.666 billion and a bridged TVL of just over $21 billion. The value is distributed across multiple protocols, each contributing uniquely to the growing ecosystem. The notable protocols include Marinade ($1.958b), Jito ($1.763b), Kamino ($1.397b), Marginfi ($827.77m), Raydium ($611.32m), BlazeStake ($467.54m), Jupiter ($383.4m), Drift ($336.49m), Solend ($283.35m), and Orca ($270.2m).

The distribution is a reflection of user preferences and emerging trends. It indicates a robust demand for liquidity solutions and yield-generating opportunities, showing that users in the DeFi space are looking for more sophisticated financial instruments. A significant trend observed is the growing interest in lending platforms, despite their relatively recent emergence in the DeFi landscape.

In related news, the demo for an Overwatch-like hero shooter, 'Nyan Heroes', was launched on the Epic Games Store. Playing the early access demo could potentially earn players future token rewards, giving them a bigger stake in the game's economy.