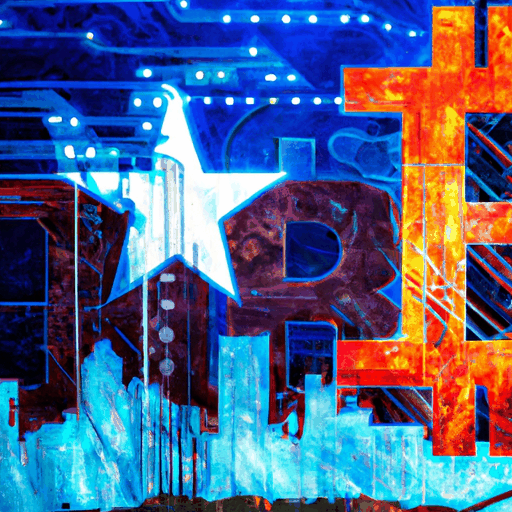

Texas Pioneers with State-Backed Bitcoin Reserve

By: Isha Das

In a landmark initiative within the cryptocurrency sphere, Texas has emerged as the first U.S. state to establish a state-backed Bitcoin reserve using public funds. This bold move underscores the recognition of Bitcoin as a strategic asset and demonstrates Texas's commitment to harnessing digital currencies for future economic prosperity and security.

Earlier this year, Governor Greg Abbott enacted Senate Bill 21 (SB21), setting up the Texas Strategic Bitcoin Reserve. This groundbreaking fund will hold Bitcoin independently of the state’s fiscal reserves, providing a hedge against inflation and fortifying Texas's financial infrastructure. Of notable interest, the new legislation limits cryptocurrency inclusion in the reserve to those with a market capitalization exceeding $500 billion, making Bitcoin the only current qualifying asset.

State Senator Charles Schwertner, the proponent of this Bitcoin legislation, highlighted the strategic need for asset diversification within state-owned holdings. Comparing Bitcoin to traditional fiscal assets like land and gold, Schwertner points out Bitcoin's superior performance over the last decade. This pioneering strategy propels Texas to the forefront of governmental entities that recognize Bitcoin's potential as a robust investment and store of value.

As Texas sets this precedent, the move is likely to inspire other U.S. states and global entities to consider similar cryptocurrency integrations in their financial policies. As corporate and public interest in Bitcoin heightens, this initiative could accelerate broader crypto adoption and innovation, positioning Texas as a leader in digital financial strategies.

For more details, please refer to the original article.