The Rise of Proof-Of-Reserves in Cryptocurrency Exchanges

By: Eliza Bennet

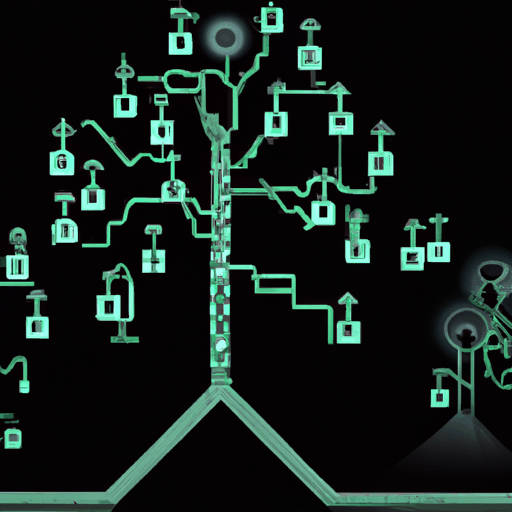

The cryptocurrency landscape continues to evolve with developments aimed at enhancing both transparency and security among users. Proof-of-Reserves (PoR) audits have emerged as a significant measure in this regard. Designed to provide transparency, these audits utilize sophisticated techniques such as Merkle trees and zero-knowledge proofs. These technologies ensure that exchange platforms can demonstrate their solvency without compromising user privacy, especially in the context of increased trust concerns following high-profile exchange collapses like FTX.

While PoR audits have proven instrumental in promoting trust, they are not without limitations. A major issue highlighted is their inability to verify liabilities, which remains a critical aspect of an exchange's financial health. Additionally, the periodic nature of these audits introduces a time gap, potentially allowing discrepancies to persist undetected. The model, although robust, is evolving to incorporate more comprehensive measures that might bridge these existing gaps.

Both of these stories exemplify the delicate balance between technological advancement and security in the crypto industry. As the sector pushes towards greater transparency through innovations like PoR audits, it simultaneously grapples with cybersecurity threats that exploit user vulnerabilities. Crypto stakeholders are called upon to remain alert and informed to navigate this dynamic and risk-laden environment.