UK Intensifies Sanctions On Russia's Crypto Channels Amid Military Funding Concerns

By: Eva Baxter

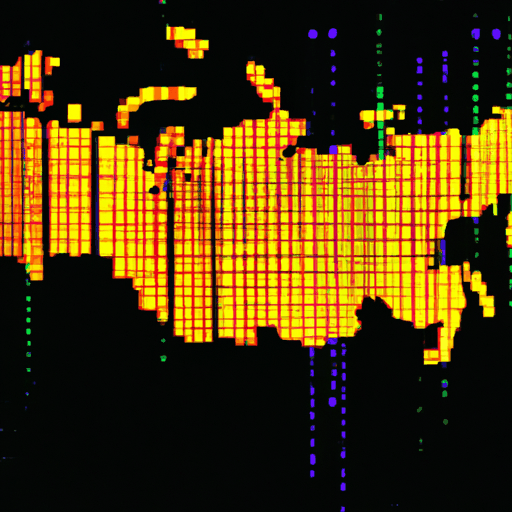

The United Kingdom has intensified sanctions on Russia's cryptocurrency ecosystem, aiming to disrupt efforts to bypass Western economic restrictions. As the conflict in Ukraine persists, the UK government has strategically targeted specific entities and platforms that have played significant roles in facilitating these evasive financial maneuvers. Notably, Kyrgyzstan’s Capital Bank and its director, Kantemir Chalbayev, have been implicated in schemes devised to procure military goods for Moscow. These measures reflect a broader objective to restrict Russia's financial capabilities amidst ongoing geopolitical tensions.

In the latest list of targets, Grinex, a crypto exchange established as a successor to the sanctioned Garantex, has come under scrutiny. This move aligns with prior actions by US and EU regulators who criticized Garantex for failing to adhere to anti-money laundering and anti-terrorist financing regulations. With Grinex openly marketed as a direct replacement for the blacklisted platform, UK authorities are keen on dismantling the crypto pathways utilized by Russian entities. Furthermore, Meer Exchange and companies linked to the ruble-backed A7A5 stablecoin, which Moscow has leveraged to sidestep sanctions, are included in these latest sanctions.

Stephen Doughty, the UK Sanctions Minister, remarked on the importance of these actions, stating that they serve as a crucial step in maintaining pressure on Russia's leadership and curbing Kremlin efforts to circumvent international restrictions. Emphasizing the global dimension of this initiative, Doughty highlighted the collaboration with the US Treasury’s Office of Foreign Assets Control (OFAC), which had similarly targeted Russian crypto entities for sanctions violations.

The A7A5 stablecoin, a focal point of concern, was issued by the Kyrgyz firm Old Vector. Backed by deposits at the sanctioned Russian financial institution Promsvyazbank, the token has circulated over $9.3 billion in transactions in just a few months. According to data from Chainalysis, the A7A5 operates within a tightly-knit ecosystem of Russian-linked financial services, predominantly executed through Grinex. The clear linkage and liquidity trace leading back to Garantex underscore the interconnected web of crypto channels utilized by Russian actors to navigate sanctions.

While these sanctions focus on Russia's crypto networks, Britain's digital asset landscape faces its obstacles. Recent reports indicate a significant proportion of UK crypto investors encounter blocked or delayed bank payments. An IG Group survey highlighted that 40% of UK crypto users experienced banking issues, compelling many to contest these barriers or switch financial providers. This growing friction brings to light the ongoing regulatory dilemmas and banking practices within the UK's digital asset domain, issues which, if unresolved, could inhibit Britain's competitive stance in the global crypto arena.