Understanding Bitcoin Liquidation Events and Their Market Impact

By: Eva Baxter

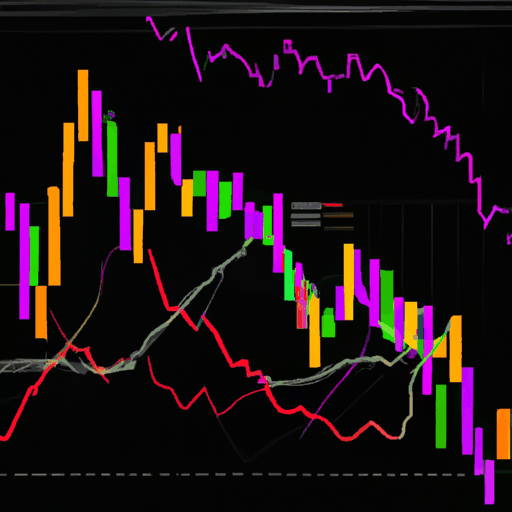

As Bitcoin continues to showcase its volatility and market dynamics, the concept of liquidation events becomes increasingly significant for crypto traders and investors. Recent movements in Bitcoin prices, surpassing the $100,000 mark, have exemplified how such phenomena can dramatically influence market trends and trader behavior. Read more about Bitcoin's recent milestone.

Liquidation events occur when a trader's leveraged position is automatically closed by the exchange, typically due to the loss of equity falling below the required maintenance margin. This is a risk management measure employed by exchanges to prevent further losses from a trader's position, which can lead to broader market consequences.

Recent data from Coinglass indicates a $175 million liquidation over the last 24 hours as Bitcoin prices surged, reflecting the low leveraged exposure within the market. This highlights how large-scale liquidations can exacerbate price movements, creating a cascading effect where forced selling leads to additional downward price pressure.

Liquidation events are crucial for understanding the dynamics of Bitcoin's movements, especially in a market characterized by high volatility. They underscore the importance of risk management strategies for traders engaging in leveraged positions. By assessing factors such as liquidity levels, market sentiment, and prevailing technical indicators, traders can better navigate the risks associated with such events.

In conclusion, as Bitcoin continues to navigate through historic price levels, being mindful of liquidation dynamics and their implications remains essential for participants in the cryptocurrency sphere.