Understanding Ethereum Staking Dynamics: Institutions vs. Retail

By: Eva Baxter

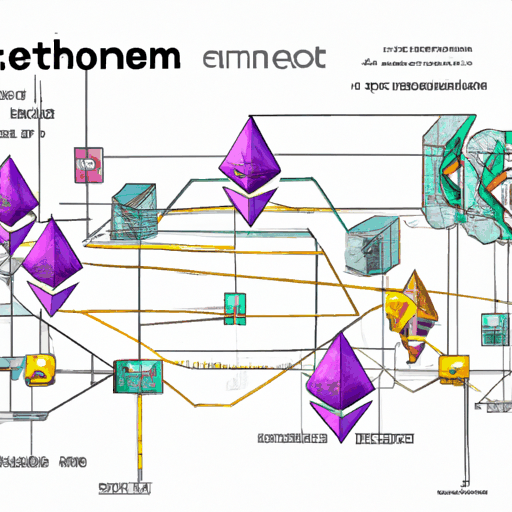

Ethereum staking has recently achieved a remarkable milestone, with over 36 million ETH staked, which equates to nearly 30% of its circulating supply. This staking boom signifies a substantial approval from holders locking in their ETH to secure the network, generate yields, and exhibit a reluctance to sell. However, this bullish development might be misleading due to the substantial influence of large stakeholders or 'whales'.

The Ethereum staking system encourages validators to lock up ETH by offering rewards for participating in the network's consensus while imposing penalties for violations. Interestingly, Ethereum’s staking setup has reached a point where the entry queue has swelled, causing activation delays that can last weeks. In stark contrast, exits from staking are processed quickly, highlighting a liquidity disparity.

The staking landscape is categorized into three groups: direct stakers, who stake their ETH via custodians without creating tradable tokens; liquid stakers, who use staking derivative tokens to maintain flexible exposure; and yield stackers, who use derivatives as collateral for further financial moves. This categorization underscores the different liquidity strategies that exist within Ethereum staking. Liquid staking keeps staked ETH within the financial markets, despite its illiquid state, thus perpetuating an illusion of liquidity.

There’s been a noted shift from retail participation to institutional control in Ethereum staking, mostly influenced by large entities like BitMine. This change indicates a swing towards institutional uses of Ethereum as a reliable yield generation instrument rather than just a speculative asset. Understanding these dynamics is crucial in evaluating the sentiment and effectiveness of Ethereum’s network security as it transitions into an institutional-grade financial tool.

For more insight into this development, click here.