Understanding Parabolic Rise in Cryptocurrency Markets

By: Isha Das

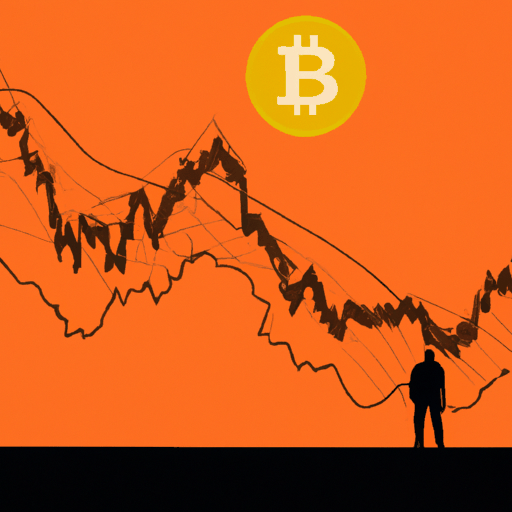

The concept of a parabolic rise in cryptocurrency markets refers to an accelerated increase in the price of a digital asset, characterizing a phase where prices escalate at a rapid, nonlinear rate. This phenomenon is often observed in the Bitcoin market as highlighted in recent discussions about Bitcoin's journey towards potentially reaching $100,000.

Parabolic rises typically follow specific market phases, such as post-halving events, where a reduction in block rewards leads to decreased supply influx for miners, thereby affecting overall supply dynamics. Investors often perceive this scarcity as a bullish signal, prompting increased buying activity and driving prices higher.

During a parabolic phase, investor psychology plays a crucial role, as the rapid price appreciation can trigger both fear and greed among market participants. The fear of missing out (FOMO) often leads new investors to enter the market at elevated prices, further fueling upward momentum.

However, while a parabolic rise can signify an asset's growing adoption and market confidence, it also poses significant risks. The market can become overheated, making it susceptible to sharp corrections. It's important for investors to be cautious and avoid overleveraging their positions during such periods of rapid price movements.