Understanding Token Buybacks and Their Economic Impact in Crypto

By: Eliza Bennet

In the realm of cryptocurrency, token buybacks have emerged as a strategic measure aimed at influencing supply and subsequently enhancing the value of the asset. A notable example includes the over $880 million allocated to crypto buyback programs over the last year. Despite their initial promise, questions persist about the true effectiveness of these initiatives, particularly as recent market observations reveal stagnant token prices despite aggressive buybacks.

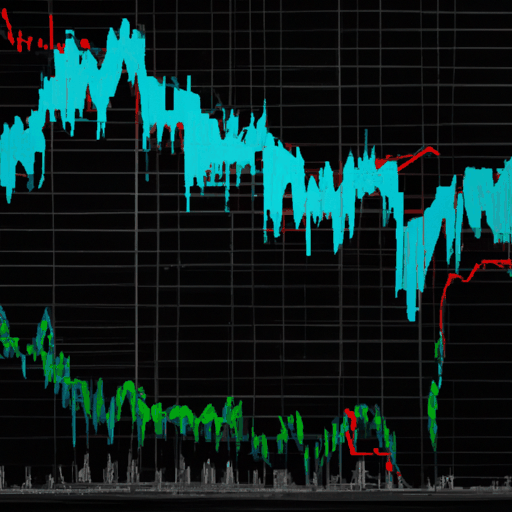

Major protocols like Optimism are at the forefront, announcing substantial buyback programs that leverage 50% of Superchain revenue for periodic OP token purchases. The intention is dual-faceted: transitioning OP from merely a governance token to a more value-oriented asset. However, as evidenced by Hyperliquid's $644.6 million buyback initiative, the market's response has cooled after initial price surges. This trend raises doubts about whether these strategies are economically substantial or simply financial performances.

For buybacks to significantly influence token valuations, they need to outpace dilution effects caused by unlock schedules. For instance, Hyperliquid illustrates this challenge, with a small fraction of its supply in circulation, signaling impending dilution that buybacks alone might not mitigate. The ongoing debate spotlights how capital should be allocated between sustaining buybacks and investing in growth through development and ecosystem expansion. Critics caution that an overt focus on buybacks could deprive protocols of crucial capital needed for competitive growth, drawing parallels to corporate finance's grappling with share repurchase initiatives.

Ultimately, successful buyback strategies are those that can credibly alter supply and demand dynamics to force token revaluation. Cases where this approach has succeeded typically feature a clear and sustained funding source, dedication to returning capital, and buybacks that exceed any new supply influx. Optimism, by earmarking part of Superchain revenue for buybacks while investing the remainder in ecosystem development, seeks a balance where growth and supply control are complementary rather than adversarial. As crypto continues to evolve, the true effectiveness of buybacks remains under analysis, with market adaptations providing eventual validation or repudiation.

For more in-depth understanding of crypto buybacks, explore related insights from sources like this article.