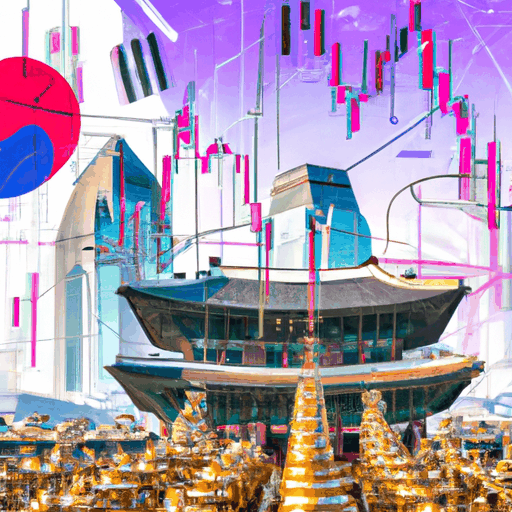

Upbit's Remarkable Growth Amidst Regulatory Challenges in South Korea

By: Eliza Bennet

South Korea's largest cryptocurrency exchange, Upbit, operated by Dunamu, reported a significant surge in earnings for the year 2024, despite facing stringent regulatory challenges. According to Dunamu's annual business filings, the company's operating profit soared by an impressive 85.1% to reach approximately 1.19 trillion won, translating to about $682 million. The firm's overall revenue also saw a substantial increase of 70.5% year-over-year, totaling 1.73 trillion won, equivalent to $1.1 billion, while net profits climbed to 983.8 billion won or roughly $670 million from the previous year.

The exceptional financial performance is attributed to increased trading activity following last year's Bitcoin halving, which reduced mining rewards, thereby impacting supply dynamics in the market. Additionally, investor confidence was buoyed by favorable sentiments following the U.S. election of Donald Trump, whose administration has embraced pro-crypto policies aimed at fortifying the digital asset landscape, encouraging substantial institutional investments. Furthermore, expectations of reduced interest rates by the U.S. Federal Reserve helped enhance global liquidity, fueling the rise in digital asset transactions.

Despite impressive financial metrics, Upbit faced considerable regulatory hurdles imposed by South Korean authorities. The Financial Intelligence Unit had earlier suspended Upbit for three months, citing insufficient due diligence on user transactions, thereby restricting new customer onboarding and asset transfers. Dunamu contested the regulatory orders, arguing that necessary compliance protocols were adhered to, with sanctions deemed unjustified and potentially harming its operational backdrop.

In a positive development for Upbit, a South Korean court temporarily lifted the restriction on March 27, allowing the company to resume full operations while the legal contestation proceeds. This temporary respite affords Upbit continued operation pending a final judicial verdict and extends a 30-day grace period post-ruling to implement any decided measures. The resolution of regulatory challenges could define the pace and consistency of Upbit's thriving growth in the ever-competitive crypto arena.