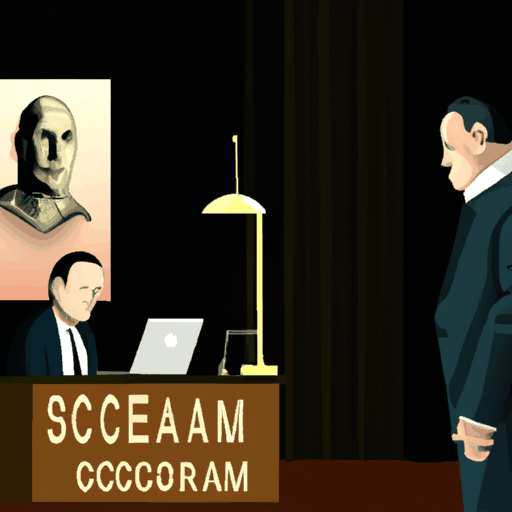

US Court Issues 20-Year Sentence for Mastermind Behind $73 Million Crypto Scam

By: Isha Das

A dramatic case unfolded in the United States courtroom as Daren Li, identified as the mastermind behind a sprawling $73 million cryptocurrency scam, received a severe sentence from the judiciary system. The sentence, pronounced in the Central District of California, entailed a 20-year prison term, the statutory maximum, reflecting the gravity of his crimes that defrauded countless American investors.

Li, who holds dual citizenship in China and St. Kitts and Nevis, orchestrated an elaborate scheme often referred to as "pig butchering." This technique involved manipulating victims through fraudulently appealing websites and domains that camouflaged as legitimate trading platforms. These operations were meticulously crafted to exploit the burgeoning interest in digital currencies and lure unsuspecting investors into transferring their funds into deceptive ventures.

The scheme's intricate setup included a network of co-conspirators, at least eight identified by the prosecutors, who assisted in creating and maintaining spoofed platforms that gained the trust of potential investors. These platforms were designed to imitate genuine trading websites, leveraging the sophisticated watchwords and themes that typically mark crypto investments. Despite the façade, all operations funneled back to the scam ring, culminating in massive financial losses.

This pivotal case highlights a significant crackdown on crypto-related frauds by U.S. authorities, aiming to safeguard investors in the virtual asset markets. The unanimous verdict and substantial sentence emphasize the judicial system's intolerance towards such fraudulent activities and its commitment to delivering justice for the victims, restoring some confidence in the cryptocurrency domain. The Department of Justice (DOJ) underscored this commitment, reiterating the significance of stringent regulation and vigilance in an ever-evolving financial landscape.