Vulnerability Discovered in Babylon Staking Code Amid Ethereum Price Shift

By: Eliza Bennet

A recent vulnerability discovered in the Babylon staking protocol may pose significant challenges to the security and efficiency of Babylon's blockchain operations. This flaw allows malicious validators to disrupt block production by omitting the hash field when posting blocks, potentially leading to validator crashes and delays in block production. According to experts, this issue primarily centers around Babylon’s block signature scheme, the BLS vote extension, which is critical for confirming consensus among validators.

The troubling sight in the Babylon staking protocol could notably impact its consensus process. Specifically, during epoch boundaries, when validators are required to agree on block hashes, malicious actors might exploit the vulnerability to cause disruption. Babylon developers have outlined this in a recent security advisory on GitHub. Proactive measures and immediate countermeasures are being assessed to mitigate the risk of such exploits, underscoring the importance of collaborative efforts and vigilance in ensuring blockchain security.

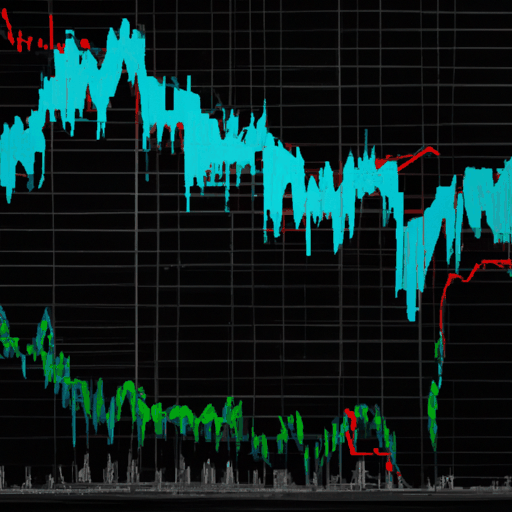

Simultaneously, the Ethereum market has been observing price fluctuations. Despite momentarily failing to exceed the $3,220 resistance, Ethereum is currently striving to regain stability, albeit facing hurdles near the $3,150 mark. The price correction saw Ethereum dip below the $3,200 mark, testing new lows at $3,050, marking a short-term bearish phase. Traders and analysts remain optimistic about a potential upward turn should the cryptocurrency maintain support above this level. Ethereum's capability to breach its immediate resistance around $3,180 could potentially usher in a rally towards $3,250.

The dynamic shifts in Ethereum prices highlight intricate interactions between market momentum and technical indicators. Key resistance and support levels remain at the forefront of stakeholder focus, with the $3,210 and $3,250 thresholds crucial for any substantial upward trajectory. The overarching optimism suggests that sustaining above the $3,050 support zone may pave the way for further gains, potentially driving Ethereum towards higher benchmarks. Nonetheless, volatility persists, warranting close monitoring of market trends and regulatory stances that could influence price momentum.